FIC publishes draft communication on travel rule compliance for CASPs

The draft PCC reinforces zero-threshold travel rule application, mandatory real-time monitoring, enhanced controls for unhosted wallets, and strict freezing obligations.

The draft PCC reinforces zero-threshold travel rule application, mandatory real-time monitoring, enhanced controls for unhosted wallets, and strict freezing obligations.

The framework formalises complaint-handling procedures, introduces mechanisms such as conciliation and summary dismissal, and will be implemented in phases.

SPVs designated as accountable institutions must comply with FICA in full, including independent registration and adherence to RMCP and reporting requirements.

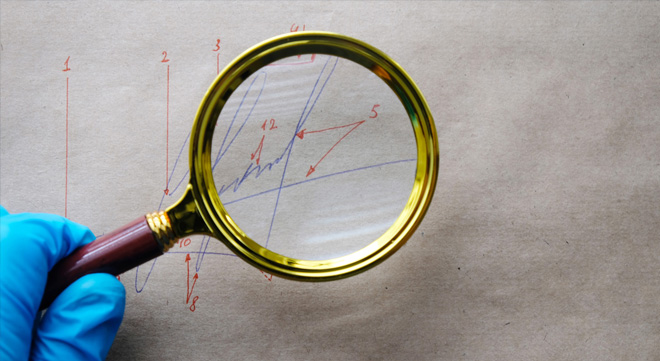

Sanlam found that the client’s signatures were forged, but its own handwriting expert came to a different conclusion.

Draft amendments to the B-BBEE Codes introduce the government’s proposed Transformation Fund into the compliance framework, reshaping enterprise development, procurement incentives, and scorecard calculations.

The Tribunal upholds the debarment of an F&I consultant who altered delivery and witness details on vehicle finance documents.

The draft ARP Manual introduces licensing, capital, and AML/CFT obligations for informal remittance providers.

The legislation will strengthen reporting and governance obligations across the non-profit, corporate, and financial sectors.

The FSP was entitled, on the information before it, to conclude that the rep no longer satisfied the fit and proper requirements.

Transferring client data to a personal, unauthorised account is sufficient to undermine the trust and integrity required of a representative.

The system introduced limited access to savings components, but it did not change the longstanding withdrawal restrictions applicable to RAs.

The effective date recorded on the FSCA’s register pre-dated any opportunity to make representations.

The Revenue Laws Amendment Act settles the treatment of provident and provident preservation fund members aged 55 or older on T-day.

Recent COIDA amendments overhaul workplace safety, claims, and compliance rules, creating new obligations for employers and expanded rights for employees.

The extent of the reporting obligation is determined by the category under which an institution falls.

The Bill largely clarifies and strengthens existing AML/CFT expectations rather than introducing a new regulatory philosophy.

The Minister of Employment and Labour removes a 2003 exemption that shielded employers from labour-inspector oversight.