Final legacy RA exemption conditions published

Commentators did not raise any significant concerns in their responses to the draft conditions, the FSCA says.

Discovery Health Medical Scheme’s contribution adjustments will be more evenly distributed across its members, highlighting the widespread effects of increasing medical inflation on contribution rates.

Commentators did not raise any significant concerns in their responses to the draft conditions, the FSCA says.

A request for a tax directive will be declined if a member is not a registered taxpayer or has outstanding returns.

Members should find out whether they will be eligible to withdraw money from their savings components.

One of the entity’s Facebook posts says it can turn R1 700 into R120 000.

FAIS Notice 25 of 2023 exempts crypto asset FSPs and KIs from the regulatory examination requirements for 18 months.

The Financial Intelligence Centre sets out legal practitioners’ obligations under the FIC Act.

The Office has sorted out the ‘embarrassing’ backlog of cases John Simpson inherited and has set timeframes for resolving complaints.

The amendments will relieve offshore companies from VAT registration when supplying services to domestic vendors, aligning SA with global best practice.

If a fund cannot follow the standard allocation methods, it must apply for FSCA approval to use an alternative, reasonable method.

Sperm does not a father make and being a biological parent does not confer absolute rights, according to a ruling by the Pension Funds Adjudicator.

Public Compliance Communication 59 has been issued following two rounds of public consultation.

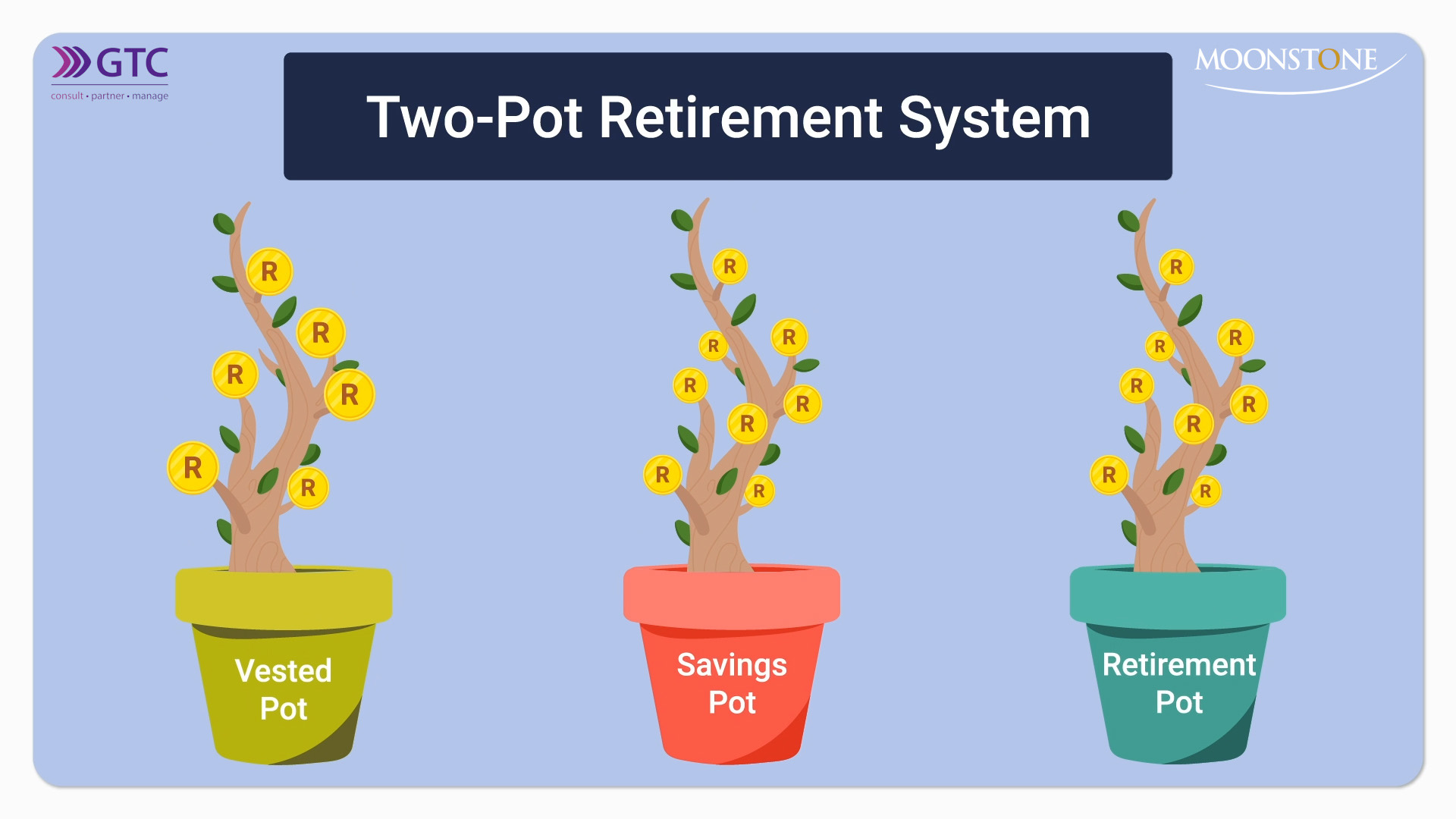

It is accompanied by three brochures that unpack different aspects of the two-pot system in more detail.

The draft Taxation Laws Amendment Bill addresses a critical anomaly in trust anti-avoidance legislation. By narrowing the transfer pricing exemption, the Bill ensures that only the correct portion of cross-border trust loans escapes double taxation.

The house, which belonged to the broker’s brother, was set alight after the sheriff served an eviction letter on the occupant.

High Court hands down a decision on the interpretation of the tracing provision in section 37C of the Pension Funds Act.

The non-compliance was discovered during inspections by the Prudential Authority in 2020 and 2022.

If a person’s year of assessment is less than 12 months, the allowable retirement contribution deduction will be applied pro rata.