Inflation is a monster, and the 2024 Budget reveals the extent of its destruction on taxpayers’ disposable income. For the first time since 2019, there is no relief from inflation for payers of personal income tax (PIT).

Finance Minister Enoch Godongwana did not raise a single tax rate, yet he will be able to get R18.2 billion more in 2024/25 tax year by “using” inflation. Neither the tax brackets nor the medical tax credits were adjusted for inflation, and there were no adjustments to the primary, secondary, and tertiary rebates.

Some employees, if they receive inflation-linked salary increases, may move into higher tax brackets. It is anticipated that individuals who were previously on the upper limit of the R95 750 tax-free threshold will fall into the 18% income tax bracket.

Massive burden

Individuals now contribute 40% of the total tax revenue collected, up from 38% last year, says Marcus Botha, tax director at BDO. The pressure on the small taxpaying base is increasing.

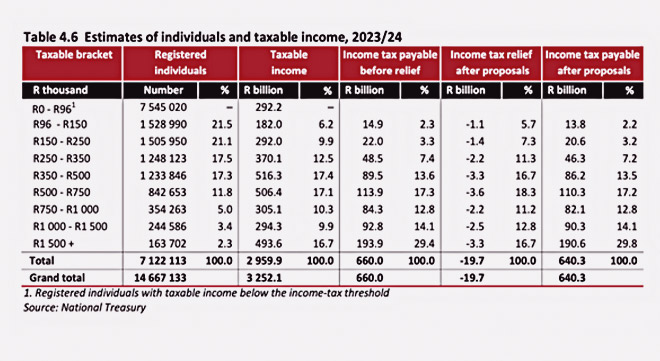

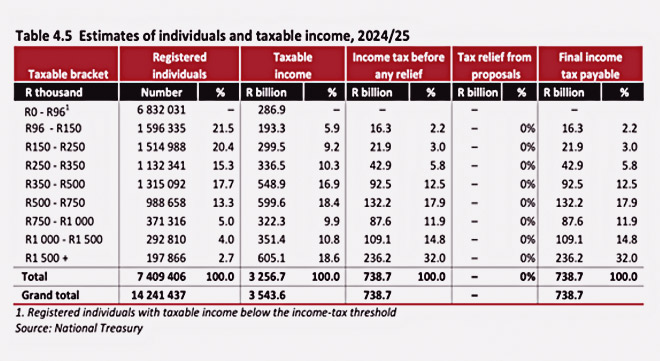

The middle-to-higher-income groups will feel the squeeze more intensely. Last year, the top-tier taxpayers (those earning more than R1 million) contributed R280bn, or 44% of the total PIT of R640bn. This year, it is estimated that the same group of taxpayers will pay R345bn, or 47% of the expected R738bn.

Botha and BDO tax partner David Warneke say there has been growing discontent among high-income earners, who argue that excessive taxation stifles entrepreneurship and undermines economic growth.

Many have left our shores. Tax statistics provided by the South African Revenue Service (SARS) show that more than 32 000 people ended their tax residency in South Africa between 2017 and 2021. Of these individuals, about 2 700 earned more than R500 000 annually and 1 100 earned more than R1m a year.

“In the aftermath of the 2024 Budget speech, affluent taxpayers will be scrutinising the fine print of tax legislation, weighing the implications for their financial portfolios and long-term wealth accumulation strategies to see if sticking around is worth it,” add Botha and Warneke.

Fiscal drag is a real drag

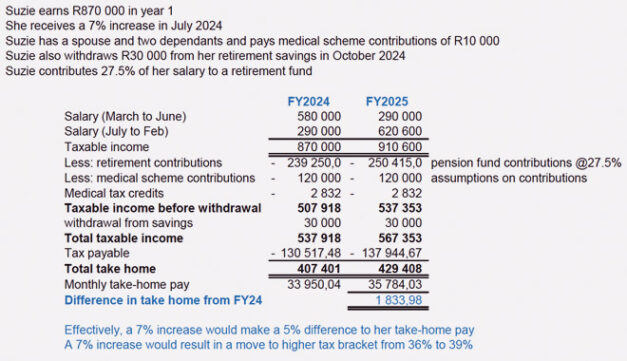

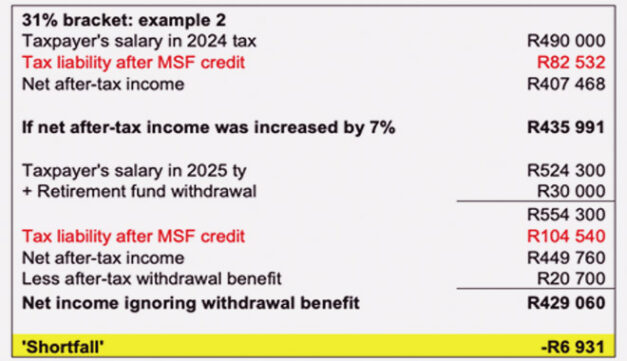

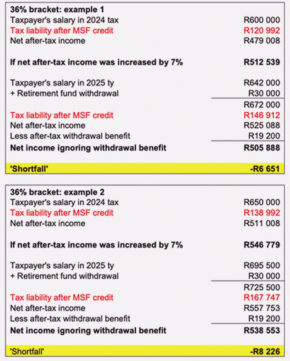

Tax experts calculated the effect of bracket creep on a taxpayer who receives a 7% salary increase and contributes to a medical scheme for herself, her spouse, and two children.

Furthermore, she withdraws R30 000 from her savings component after the two-pot retirement system takes effect from 1 September.

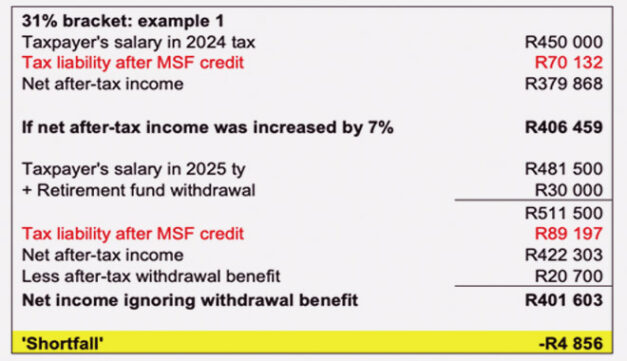

Althea Soobyah, tax partner at Mazars, did several detailed calculations for Moonstone that show the impact, depending on where the taxpayer falls in the tax bracket. Fiscal drag or bracket creep can slice between 2% and 3% from the increase. Someone who is on the upper limit of a tax bracket could be pushed into a higher tax bracket, as illustrated by Soobyah in the following example.

Soobyah says it appears that the main revenue drivers over the medium-term tax years (2024, 2025, and 2026) will be no inflationary relief for fiscal drag, no adjustments to the medical tax credits, and above-inflation increases on the excise duty of alcohol.

This will enable SARS to collect an additional R15bn this year, R15.93bn next year, and R24.6bn in 2026. The jump in additional revenue in 2026 is because of expected tax income of R8bn from qualifying multinational companies with the introduction of the global minimum tax rate of 15%.

The government has softened the blow by pencilling in no adjustments to the fuel levy for the same period, resulting in R4bn revenue foregone this year, R4.24bn in 2025, and R4.52bn in 2026.

Aneria Bouwer, senior consultant at Bowmans, also says it appears from the Budget Review that National Treasury does not intend adjusting the tax brackets for at least another two years.

“I also suspect there is no intention from government to increase the medical scheme fee (MSF) credits in the future. A taxpayer with a spouse and two dependants will only receive R14 640 per year in tax credits, notwithstanding the contribution to a medical scheme.”

She illustrates, in the following examples, how the inflation monster eats into taxpayers’ earnings if there is no relief for inflation, assuming a taxpayer receiving a 7% increase.

And the shortfall grows the higher the tax burden becomes.

Politically charged

Botha described the 2024 Budget as “politically charged”. In an election year, the minister had to keep things as “neutral” as possible. He had very little wiggle room. There is no money, and the government cannot afford to borrow more.

So, individuals are targeted to carry the burden. Surely there were other options instead of making everyone poorer by not giving inflationary relief, says Botha.

He refers to the R1.4bn that was allocated to the National Health Insurance plan and the payment to members of the Southern African Customs Union. These payments increase from R80bn last year to almost R90bn in 2024.

“This is money for nothing,” says Botha.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning, legal or tax advice that is appropriate to every individual’s needs and circumstances.