A 4% increase in the general fuel levy and the withdrawal of the two 0.5-percentage-point increases in the rate of value-added tax are the only significant tax-policy changes announced in the Budget that was tabled yesterday.

The decision to scrap the VAT increases planned for the 2025/26 and 2026/27 fiscal years means the proposal to expand the basket of zero-rated food items beyond the current 21 items has also been withdrawn.

According to National Treasury’s Budget Review in March, the government hoped to raise R13.5 billion from the VAT increase in 2025/26, although it would “forfeit” R2bn as a result of zero-rating the additional items.

The prospect of additional revenue from the VAT increase has fallen away. The government wants to “replace” a portion of the lost revenue by increasing the general fuel levy on 4 June.

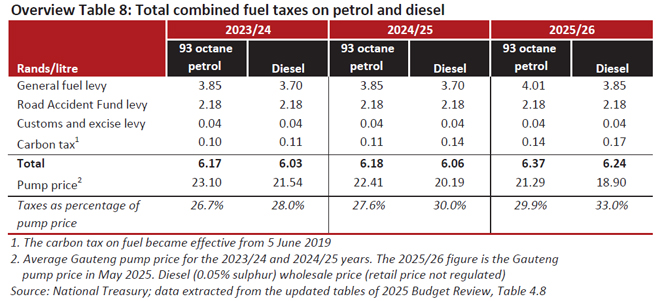

The general levy for petrol will increase by 16 cents, from R3.85 to R4.01, and for diesel by 15 cents, from R3.70 to R3.85.

National Treasury says these inflation-linked increases will not raise additional revenue per se. Instead, they mean Treasury will not forfeit R4bn in revenue in 2025/26, as would have been the case without the inflationary increases, as proposed in the Budget in March.

The general fuel levy, as well as the Road Accident Fund (RAF) levy and the customs and excise levy on petrol and diesel, was last increased three years ago.

The RAF levy and the customs and excise levy will not be increased.

Budget 3.0 retains the proposal in Budget 2.0 to increase the carbon tax on fuel slightly in 2025/26, from 0.11 cents to 0.14 cents on 93 octane and from 0.14 cents to 0.17 cents on diesel.

The combined impact of the increases in the fuel levy and the carbon tax is that motorists will pay tax of R6.37 on every litre of petrol and R6.24 on a litre of diesel.

The increase in the fuel levy will have a knock-on effect on transport and food prices, which will pinch household budgets.

Will SARS collect more tax debt?

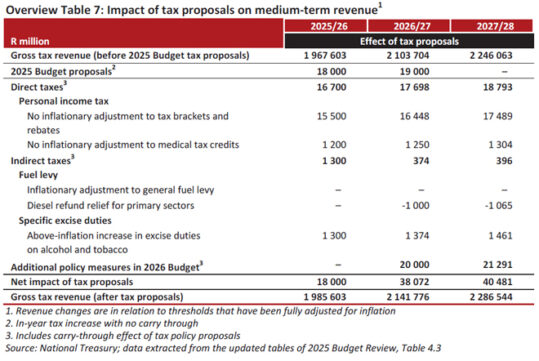

The tax proposals in Budget 3.0 aim to raise R18bn in 2025/26, taking gross tax revenue to R1.985 trillion. This is R10bn less than the additional revenue the government hoped to raise in Budget 2.0, which pencilled in gross tax revenue of R2.006 trillion in 2025/26.

The increase in the general fuel levy will not be sufficient to make up for the revenue lost by withdrawing the VAT increases. Therefore, the Minister of Finance will announce measures to raise an additional R20bn in next year’s Budget.

However, the R20bn in tax increases will be “reconsidered” if the South African Revenue Service collects more outstanding tax, says the Budget Overview published yesterday.

In 2024/25, SARS collected R95bn in tax debt. Treasury has allocated an additional R7.5bn to SARS over the next three years, part of which is expected to boost its ability to collect debt – from R20bn to R50bn a year.

SARS Commissioner Edward Kieswetter told a media conference before the Budget speech that the funding enables SARS to hire up to 1 700 additional debt collectors. About 500 were hired in April and have started training, and another 250 will be appointed in June.

“This ringfenced project should give us at least another R20bn. We therefore target a debt collection from the overall composite debt resources that we employ of at least R120bn,” Kieswetter said.

In his Budget speech, Finance Minister Enoch Godongwana said he believes the R7.5bn allocation will enable SARS to collect at least R35bn in additional taxes.

“This potential revenue is not included in the revenue estimates. However, the performance of SARS will be monitored by assessing the change in the amount of cash collected from debt, which will be published monthly,” the Budget Overview says.

Spending reviews

Another factor that will determine whether taxes are increased next year is the outcome of the reviews of government spending.

Spending reviews have identified “tens of billions of rands” in potential savings from poorly performing or inefficient programmes that can be redirected in future Budgets, the Overview says.

“If government achieves significant savings from implementing the recommendations of these reviews, it may mitigate the need for additional tax measures in the 2026 Budget.”

National Treasury and provincial treasuries have assessed more than R312bn in spending programmes since 2013, highlighting shortcomings in policy costing, implementation, and oversight that lead to duplication and waste.

Previous reviews have identified savings of R37.5bn that can be achieved from changes to operating models and improvements in oversight. In some cases, programmes no longer achieve their intended objectives and should be closed.

Personal income tax

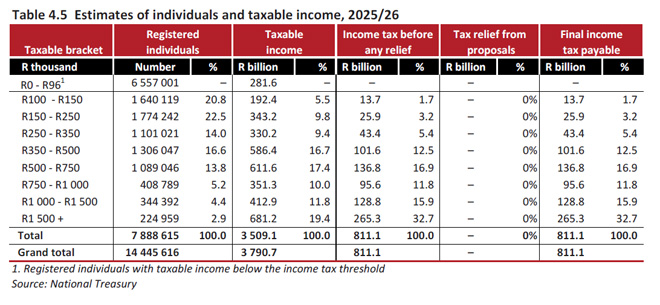

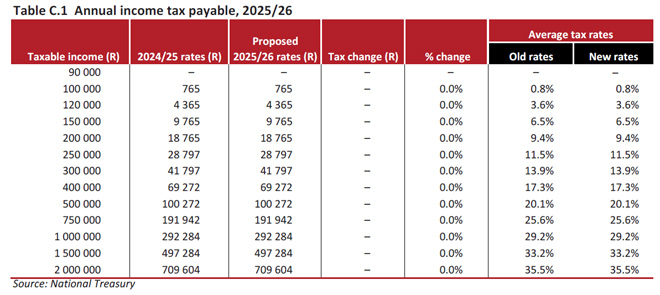

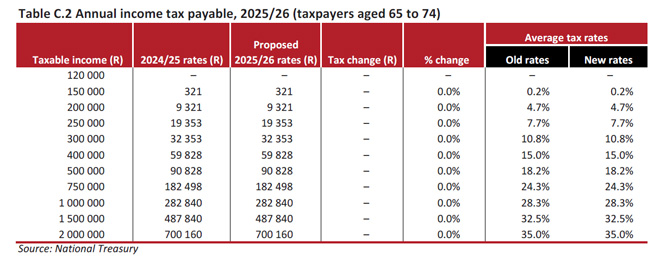

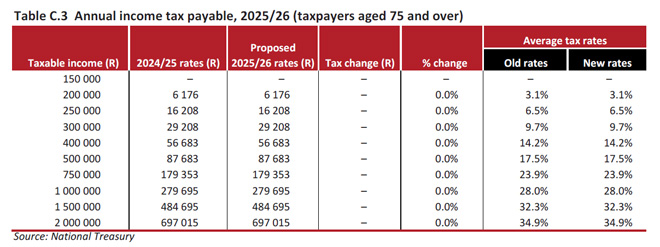

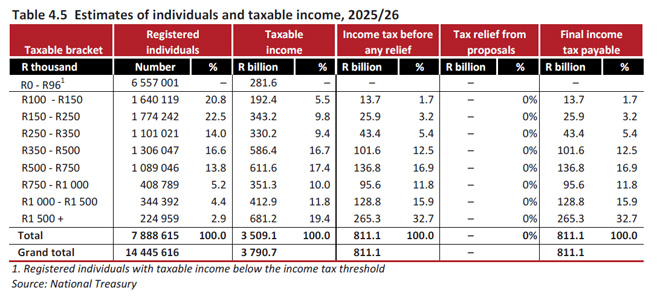

As was announced in the March Budget, there will be no adjustments to the PIT brackets and rebates in 2025/26. This is the second consecutive year in which the PIT brackets have not been adjusted to combat “bracket creep”, the term used to describe what happens if the income bands are not fully adjusted to account for inflation-linked salary or wage increases.

The absence of the inflation-linked adjustment means that payers of PIT will ultimately take home less – particularly if their salary increase pushes them into a new tax bracket. If the tax brackets had been adjusted, taxpayers would still pay more in tax, but it would be in line with their increase.

The decision to scrap the inflation-linked adjustment means the PIT tables for 2025/26 are the same as they were in 2024/25.

According to the Budget Overview, the government will raise R15.5bn in 2025/26 by not adjusting the PIT brackets and rebates, and R16.4bn in 2026/27, and R17.5bn in 2027/28.

Medical tax credits

As was in the case in Budget 2.0, the medical tax credits will not be adjusted for inflation. They will remain at R364 per month for the first two beneficiaries and at R246 per month for the remaining beneficiaries.

The Budget Overview says not adjusting the medical credits will raise R1.2bn in 2025/26, R1.25bn in 2026/27, and R1.304bn in 2027/28.

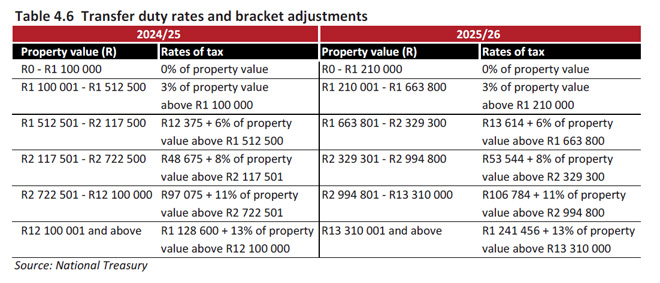

Transfer duty on property transactions

The revised Budget confirms the increases to the value bands for the duties that are paid when a property is sold. The price brackets were adjusted by 10% on 1 April. The transfer duty tax rates remain unchanged.

The adjustment to the brackets will result in transfer duty kicking in from R1.21 million instead of R1.1m.

Excise duties on alcohol and tobacco

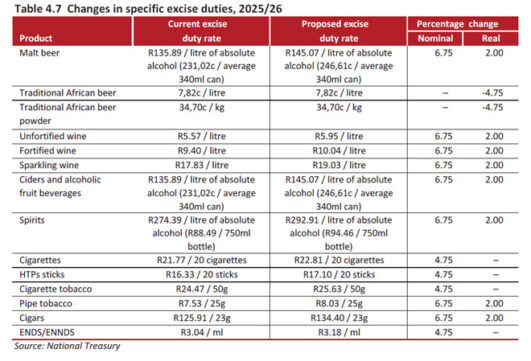

Budget 3.0 proposes to retain the above-inflation increases in the excise duties on alcohol and tobacco products announced in Budget 2.0.

The excise duties on alcoholic beverages will increase by 6.75%.

The duties on cigarettes, cigarette tobacco, and vaping, formally called electronic nicotine delivery systems (ENDS) and non-nicotine delivery systems (ENNDS) will increase by 4.75% instead of 4.83%.

The proposed increase for pipe tobacco and cigars is 6.75%.

The government plans to raise R1.3bn in revenue in R2025/26 by increasing the duties on alcohol and tobacco.

No changes to these taxes

The Budget does not propose changes to the following:

- capital gains tax;

- dividends tax;

- donations tax;

- estate duty;

- the thresholds for the exemption on interest income;

- tax-free investments; and

- the tax treatment of contributions to retirement funds.

An inflation-linked increase in the health promotion levy (or “sugar tax”) was due to take effect on 1 April, but this was cancelled in the March Budget. The cancellation of the increase is to allow the sugar industry more time to restructure in response to regional competition.

Tax revenue estimates

Treasury estimates it will bring in R1.86 trillion in tax revenue in 2024/25, which is R8.9bn better than its estimate in the March Budget. It attributed the improvement to a large once-off dividends tax receipt and lower-than-anticipated VAT refunds. However, the estimate is R7.8bn lower than the forecast in last year’s Budget.

As a result of the weaker economic outlook and the reversal of the VAT rate increases, Treasury has revised the medium-term revenue outlook down by R61.9bn, compared with what it expected in March. However, this is R75.9bn higher than what was projected in the 2024 Medium-Term Budget Policy Statement.

Treasury expects gross tax revenue to rise from R1.985 trillion in 2025/26 to R2.286 trillion in 2027/28.

The tax-to-GDP ratio is expected to reach 25.7% by 2027/28, slightly higher than the 25.4% projected two months ago. The ratio remains largely in line with previous estimates because of the better-than-expected revenue outcome for 2024/25, tax increases over the next two years, and strong tax buoyancy in key revenue instruments such as PIT.

Our Government lacks accountability on misused government funds. Ministers, companies, tenderers steal alot of money meant to improve this country. South Africa ends up finding itself spending this years budget on projects that were supposed to be done 5 or 10 years ago where the money was allocated to companies to complete those old projects. No one is held accountable, no one is arrested instead they protect each other, the current state of our economy we cant expect South Africans to suffer even more by increasing VAT, Its unjust.

We need good leaders who will not allow corruption, because corruption is what keeps our country behind.