Deepfake profits and ‘overwhelming’ illegality: Banxso liquidated

The High Court finds Banxso knowingly benefited from deepfake adverts, misled clients about its licence and returns, and is ‘hopelessly insolvent’.

The High Court finds Banxso knowingly benefited from deepfake adverts, misled clients about its licence and returns, and is ‘hopelessly insolvent’.

Medscheme’s bid to halt Bonitas’ administration transition has been delayed after procedural lapses and unresolved interlocutory issues forced the matter off the urgent roll.

With applications closing on 15 June, MBSE’s FETC NQF 4 programmes offer a final chance to secure recognised FAIS credits before more restrictive replacements take effect.

The draft PCC reinforces zero-threshold travel rule application, mandatory real-time monitoring, enhanced controls for unhosted wallets, and strict freezing obligations.

The framework formalises complaint-handling procedures, introduces mechanisms such as conciliation and summary dismissal, and will be implemented in phases.

In this edition of Cover to Cover, we unpack the structural, regulatory, and underwriting differences that advisers must clarify before recommending either healthcare funding option.

The changes include the increase in the annual tax-deduction cap, and new annuitisation and living annuity commutation thresholds.

Opting for personal cover to save on premiums can backfire. Insurers may reject claims if income-generating use was not disclosed.

SPVs designated as accountable institutions must comply with FICA in full, including independent registration and adherence to RMCP and reporting requirements.

The terms of two deputy commissioners were also renewed, while the third deputy will step down at the end of May.

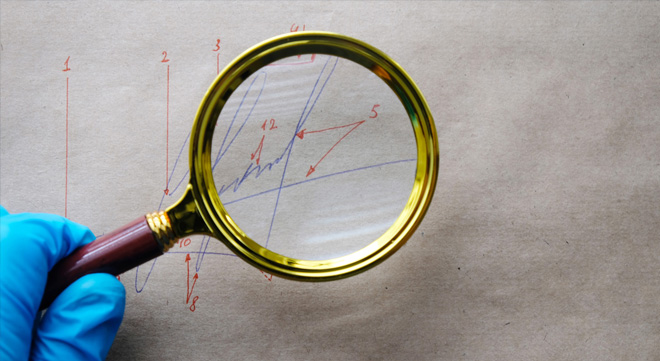

Sanlam found that the client’s signatures were forged, but its own handwriting expert came to a different conclusion.

From CGT thresholds to small business tax and foreign allowances, Ronald King identifies the changes that could materially reshape financial plans.

The FSCA says Grobler contravened the Financial Markets Act by publishing false or misleading financial statements between 2014 and 2017.

National Treasury Director-General Duncan Pieterse says South Africa’s core fiscal challenge is structurally low economic growth that trails population expansion.

For investors, geopolitics is no longer background noise. It is a core driver of supply chains, inflation, and sovereign risk premia, says Momentum’s Sanisha Packirisamy.

Social media may feel informal, but legally it is still publication. And publication – if defamatory – can lead to court orders, retractions, and substantial legal costs.

The judgment also reinforces that generic voetstoots clauses or poorly explained limited warranties cannot waive statutory rights under the CPA.