A dividend-focused investment solution can be a valuable addition to an investor’s overall equity portfolio in both bull markets and bear markets, broadly improving its diversification and quality characteristics.

However, caution is required when choosing the underlying stocks, because a high dividend is not always the sign of a healthy business. This two-part article examines the benefits of dividend-focused investments and their drawbacks, providing some practical South African examples.

What is dividend-focused investing?

Dividend-focused investing is the strategy of holding exposure to high-dividend-paying stocks in a portfolio with the aim of earning a steady (and growing) income from dividend payments in addition to potential capital growth from rising share prices. Dividends can also be reinvested to provide compound growth over time.

This strategy can reduce portfolio risk, but dividend investors are likely to forego some capital growth upside because of the slower-growth nature of high-dividend-paying companies.

Adding diversification and defensive qualities

A dividend-focused fund has been shown to be a solid diversifier from a standard FTSE/JSE All Share Index-benchmarked fund. Dividends can provide a source of regular short-term income, while also acting as a buffer for returns in volatile equity market conditions. After all, a company’s ability to pay dividends from its cash flows does not suddenly deteriorate during a broader equity market downturn.

Equally, dividend investing is considered to be a more defensive style of equity investing for several reasons:

First, high-dividend-paying companies have historically been described as “blue chip”. They are sometimes also termed “value” companies. They tend to be larger, more mature, and slower-growth businesses than their low- (or no-) dividend-paying counterparts because they are able to pay out larger portions of their earnings in the form of regular dividends to shareholders, requiring lower investment or research spending. They may have already experienced their major growth phase and are consolidating their operations or improving profits by other means than cash investment.

Second, the more mature nature of these companies means their finances and operations are generally better able to weather economic and financial market downturns than their lower-dividend-paying counterparts, with lower debt, higher profitability, and more clients. Consequently, their share prices can demonstrate different behaviour across market cycles, reinforcing the diversification benefits of these shares.

Third, high-dividend-paying companies are found across a range of sectors, allowing for a variety of portfolio holdings. They typically operate in sectors where large capital investment (or fixed cost) is required up front, and growth is then scaled up through smaller incremental spending from that base, generating high cash flow. Such sectors include financial services, energy, utilities, basic materials (resources), healthcare, and consumer staples. Regulation can also dictate a strong dividend-paying corporate financial mode: Real Estate Investment Trusts (REITs), for example, are required by law to distribute a minimum of 75% of their annual taxable income to shareholders.

South Africa’s top dividend payers

South Africa’s high-dividend-paying companies are found in the same sectors as their global counterparts. The 10 largest holdings in the Satrix Dividend Plus Index Fund, for example, comprise Investec, Old Mutual, Ninety One, Absa, Nedbank, Exxaro, African Rainbow Minerals, British American Tobacco, AVI, and Tiger Brands.

Importantly, this list excludes all but one of the 10 largest shares in the FTSE/JSE All Share Index (ALSI), which currently includes Naspers, Prosus, FirstRand, Gold Fields, Anglogold Ashanti, Standard Bank, Capitec, and MTN, with British American Tobacco as the only exception. As such, a higher weighting to dividend-paying companies such as these can function as a solid diversifier in a South African equity portfolio.

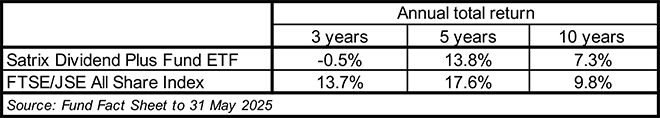

This is evidenced by the variety of returns generated by the Satrix Dividend Plus Index Fund over time compared to the ALSI, as shown in the table.

Low dividends = higher risk?

Low-dividend-paying companies, meanwhile, invest higher proportions of their profits back into their business to expand rapidly, capture a growing market share, or improve their products and services, among other purposes. These “growth” companies can be in an early stage of their development, focusing on a new market or exploiting a new gap in an existing market, all higher-risk activities. Here investors will typically find higher levels of leverage, because growth companies may look to debt for additional funding given their typically lower levels of profits. And importantly, their investment returns rely solely on share price appreciation, making their shareholders fully at the mercy of sentiment-driven equity markets.

Technology companies are the best example of growth companies, particularly in today’s environment of accelerated innovation, and there are few technology companies listed on the ALSI apart from the Naspers and Prosus exposure to the giant Chinese gaming group Tencent.

The second part of the article will provide more performance analysis, options for dividend-focused investment portfolios, and discuss why using dividend yield as the only metric of an investment decision is a risky move.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.