Discovery Invest says its recently launched Lifespan Linked Income Plan provides retirees with robust protection against the financial risks associated with longevity, while maintaining income flexibility and investment growth.

The product is not a hybrid annuity, which, Discovery contends, do not address the disadvantages of fixed annuities and living annuities.

The product is structured as a living annuity, but a portion of the fund value is used to buy a deferred guaranteed (fixed) annuity.

The Lifespan Linked Income Plan, which opened for investment in May this year, requires a minimum investment of R300 000.

Longevity risk

People are living longer thanks to advances in healthcare technology, better disease prevention, and healthier lifestyles. Discovery Invest cites research by the World Economic Forum, which shows that on average, retirees outlive their savings by more than 10 years, and for women, this gap stretches to 13 years.

Despite this, most retirement strategies are based on traditional assumptions from when life expectancy was far shorter and less variable. According to data from Discovery’s Vitality programme, the average life expectancy is 83, but more than 60% of retirees will live beyond this age.

According to an analysis by Discovery Invest, an individual whose retirement planning assumes living to the age of 80 but who lives to age 90 will have cut his or her annual retirement income by 47%.

In addition, while life expectancy continues to rise, health span – the years lived in good health – often lags behind, leaving many people living longer but spending their final decade or more in poor health.

According to Discovery data, the average person spends over 10 years in poor health, paying up to three times more in out-of-pocket medical costs as they age. About 70% of people aged 65 and over will eventually need long-term care, with costs ranging from R8 000 to R25 000 a month for home nursing and up to R75 000 a month for dementia care.

“The combination of longer lives and rising healthcare costs means retirees face a double risk: outliving their savings and carrying a heavier medical burden in later years. Unfortunately, retirement planning hasn’t kept pace with the new challenges that retirees will face,” says Kenny Rabson, the chief executive of Discovery Invest.

Traditionally, retirees have had a choice between living annuities and fixed annuities.

Living annuities provide flexibility and market exposure but carry the risk of outliving one’s savings if withdrawals are too high or investment returns are too low.

Fixed annuities guarantee income for life, but lock retirees into rigid income structures, sacrificing flexibility when needed. In addition, capital is sacrificed on death, often leaving no legacy plan for beneficiaries.

Rabson says there is a growing market of hybrid annuities that combine living and fixed annuities, but these structures are often actuarially inefficient.

“They commit a significant portion of the retirement fund to fixed annuities early from the retirement date, when longevity protection is not yet needed. Ultimately, this reduces the capital available for growth and leads to early capital depletion, limits income flexibility, and locks in a client’s many years of saving at interest rates on a single date. The cost efficiency of over 90% is attained by deferring the longevity protection to later years,” he says.

Product features

Discovery Invest says its Lifespan Linked Income Plan has four key features:

- Income flexibility. Retirees can adjust withdrawals as their needs change across all phases of retirement, from the active phase (early years of retirement) to the sedentary phase (from age 70 to about age 80) and the supported phase (after age 80), which is when healthcare costs typically rise.

- Market exposure. Their savings remain invested for growth throughout retirement, helping to preserve wealth and reduce the risk of outliving capital.

- Longevity protection. From the later of age 80 or 15 years from the investment, a deferred guarantee activates to provide income for life at a lower cost than traditional fixed annuities.

- Wealth transfer. Any remaining capital can be transferred to beneficiaries, ensuring they receive a legacy rather than losing funds on early death.

Rabson says the product is not a hybrid annuity.

“This product works differently – it keeps full flexibility and growth potential early in retirement while using a cost-efficient, deferred guarantee that only activates from age 80. This means retirees keep control of their money, benefit from market growth, and have the certainty of guaranteed income later in life, without sacrificing capital or flexibility,” he says.

The Discovery product has two main components:

- An income boost, to incentivise clients to choose lower draw-down levels and live a healthy lifestyle.

- Longevity risk protection.

Income boost incentive

The product leverages Discovery’s shared-value model, rewarding healthy living and responsible withdrawal behaviour. The lower the draw-down and the higher the Vitality status, the more the monthly income boost.

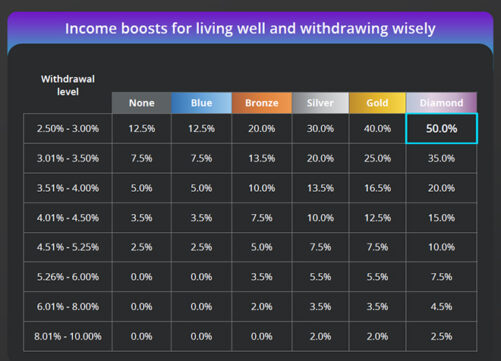

The matrix below showing the relationship between the draw-down level and Vitality status refers. The percentages in the columns under the Vitality levels are the income boosts.

During a webinar this week, Craig Sher, Discovery Invest’s chief product and investment officer, said Discovery wants to incentivize clients to move towards the top-right-hand corner of the matrix – to be drawing as little as possible and to be as healthy as possible. For example, if someone is drawing 2.5% to 3% and is on Diamond status, Discovery Invest will boost his monthly income by 50%. So, if that person is drawing R10 000 a month, the 50% boost will result in an income of R15 000.

According to Discovery’s research, its shared-value model has a significantly positive effect on retirement outcomes.

“For example, Discovery Invest clients in retirement have received, on average, between 17% to 46% in enhancements to their retirement income for those engaged in the Vitality programme. A reduction in income withdrawal rates is also evident on the living annuity since the launch of this structure in September 2015, with an 11% reduction in the amounts withdrawn. Although causality cannot be directly inferred, it appears that clients are reducing withdrawals to maximise the boosts they receive. If this trend of reduced withdrawal rates continues, clients’ retirement funds are projected to be 30% higher than they would otherwise have been.”

Sher said the income boost has also been integrated with Discovery Health Medical Scheme’s Personal Health Pathways, an AI-powered digital programme that offers personalised health and exercise guidance to members.

A client who closes a Personal Health Pathways ring (performs a recommended action) will be accorded a minimum of Gold status when the income boost is calculated in the following month. Clients can earn a boost this way up to three times a year.

Clients who are on Gold or Diamond status do not receive an additional income boost by closing Personal Health Pathway rings closures, because they are already receiving a higher income boost through the normal income boost structure, Sher said.

Longevity protection

The second component, longevity protection, is achieved through “a specially designed” fixed annuity.

The guarantee starts from the later of age 80 or 15 years from the investment and pays for the rest of the client’s life.

“It doesn’t depend on the fund value being in force. If the client totally decimates their fund value at any stage before that for whatever they need, this guarantee still kicks in, and it still pays out for as long as that client will live,” Sher said.

Currently, the guarantee does not increase each year, although Sher said this might change for new business.

Discovery Invest has designed the guarantee so that it is about 95% more cost efficient than buying a fixed annuity from age 65, which means that some 95% of the fund value can be used for whatever the client wants in terms of the living annuity, and only about 5% is used to provide the longevity protection.

In other words, whereas with a fixed annuity, a client must use 100% of the fund value to buy an income stream that will last, with the Income Plan, the client uses about 5% the fund value to buy the guarantee.

Sher says the guarantee – it is currently 5.75% – can be paid upfront or as an ongoing fee. If the client chooses the latter, and the upfront amount is, for example R1 000, the monthly amount would be about R10.48.

The guarantee applies irrespective of whether a client chooses Discovery funds or external funds as the underlying investments for the living annuity.

If the client dies before age 80, the entire fee is refunded.

The annual administration fee for the Lifespan Linked Income Plan is the same as for the Discovery Living Annuity.

An example of how it works

To illustrate how the components fit together, Discovery Invest provided a case study of a 65-year-old client called Greg who has R3 million in retirement capital. The case study assumes Greg starts with a 3% withdrawal level and increases his withdrawal to match his lifestyle needs. At age 80, he is withdrawing 9% of his fund. The case study assumes investment growth of 8% a year.

With a traditional living annuity, if Greg draws down 3% of his fund value, he will receive an income of R90 000 a year. With the Lifespan Linked Income Plan, he will receive R90 000, plus the 50% boost if his Vitality status is Diamond, providing a total income of R135 000.

At age 80, taking into account asset growth, Greg’s income from the traditional living annuity is R395 924. With the Discovery product, he receives R395 924, plus a guaranteed income of R233 184, giving him a total income of R629 108.

If Greg lives to age 90 or beyond, the traditional living annuity will give him an income of R332 861. His income is starting to decrease because the fund value is starting to come down. With Discovery, he will receive R332 861, plus the guaranteed income of R566 045.

The Lifespan Linked Income Plan will keep paying out the guaranteed amount of income if Greg lives to 100, or 110, or even longer.

“The new solution takes the best of features of fixed and living annuities. You get the market growth. You can invest it in whatever funds you want. The remaining fund value is available to clients’ beneficiaries or dependants. The income that the client will receive will be at least as flexible as the living annuity, plus they’ll get this additional amount for managing their money well. And importantly, in terms of longevity protection, it is payable for whole of life, and it is 90% to 95% cheaper than buying through a traditional fixed annuity,” Sher said.

This article was updated on 29 August to include that the guarantee currently does not increase.

Disclaimer: This article is for informational purposes only. Individuals should seek advice from a qualified financial adviser when deciding on an annuity product that is suitable for their particular needs and circumstances.

How are the increases in the guaranteed income from age 80 calculated? are they based on a fixes percentage or CPI or investment growth?

The guaranteed income at age 80 is currently static with no increases, although Discovery may modify this in the future for new business.

This is the comment from Craig Sher, chief product and investment officer at Discovery Invest: “The reason for us designing with no increases at the moment is that our preference is to give as high a guarantee as possible at age 80. If we were to include increases, then, by definition, the guarantee at age 80 would be lower so it could increase later in life. Our feeling is that clients would prefer as much guaranteed money as soon as possible when they reach older ages. The rest of their very flexible living annuity (that they are getting boosts to manage appropriately) would fund any additional amounts they might need at those older ages.”