Most would agree that innovation is a force for good – but it rarely comes without disruption. For active asset managers, the challenge lies in ensuring investors’ capital is positioned on the right side of the disruption divide.

Peter Kempen, the head of distribution at Coronation, explored this theme during his presentation at the PSG Financial Services Annual Conference last week, highlighting how innovation has reshaped – and continues to reshape – the asset management landscape.

To illustrate how even once-dominant companies can be blindsided by disruption, Kempen compared the top 10 global tech stocks by market capitalisation in 2007 with their standing in 2025.

Of the 2007 leaders – Apple, Alphabet, Microsoft, Oracle, Samsung Electronics, IBM, Cisco Systems, Intel, Nokia, and Hewlett-Packard – only four (Apple, Alphabet, Microsoft, and Oracle) managed to outperform the market. Another three (Samsung, IBM, and Cisco) increased their market cap but still underperformed relative to the broader market. The remaining three – Intel, Nokia, and Hewlett-Packard – lost between 40% and 80% of their value.

What led to the sharp divergence in performance?

Kempen pointed to a common thread: failure to adapt to the rise of mobile computing and smart devices.

“Intel declined to manufacture the processors for iPhones… Nokia didn’t think that touchscreens were going to be a big thing, so they fell behind there. Hewlett-Packard thought that personal computing would remain fairly stationary. They didn’t adapt to mobile computing and mobile devices, so all of those fell way behind.”

The lesson, he said, is that change is constant – and the ability to respond to it is critical.

“It’s important, from an active asset manager’s point of view, to be on the right side of that disruption divide. And from your perspective as an adviser, as investors, it’s less important. You don’t need to worry that much about the innovation and disruption in the asset management industry. What it’s more important to worry about – is your chosen manager able to adapt and identify those disruptions and make the right decisions?”

Disruption brings opportunity

Like the tech industry, Kempen noted, the asset management industry has also experienced significant disruption – particularly in two key areas: the growth of passive investing and the shortening of investment time horizons.

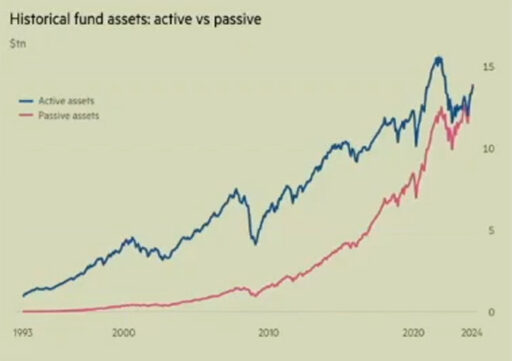

He pointed out that globally, passive assets have now overtaken active assets. Passive investments aim to replicate the performance of a market index, such as the S&P 500, with minimal trading. In contrast, active investments are managed by professionals who seek to outperform the market through research and informed decision-making.

“In the US, that move is something along the lines of $3 trillion that’s moved from active to passive, and that has resulted in an environment where a lot of money is allocated in passive on the basis of market-cap-weighted indices,” he said.

The result, Kempen explained, is that a large portion of capital is now being allocated without any fundamental research.

“It’s often chasing momentum. It creates a bit of a self-fulfilling prophecy. And you’ve got this capital allocation that is quite often momentum-based, and we think that that creates an opportunity for fundamental research, for active managers that still look at underlying value to create alpha.”

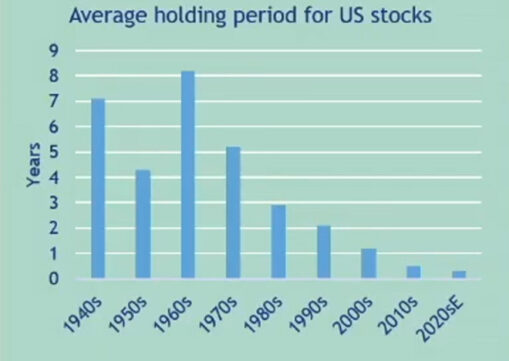

Turning to the second area of disruption – the shortening of time horizons – Kempen said the average stock holding period has dropped significantly over the past four or five decades. A major driver of this, he noted, is the rise of quantitative (or “quant”) trading.

Kempen explained that quant trading differs from algorithmic trading.

“Algorithmic trading is rules-based. It’s all about execution. Quant trading is what you buy and making decisions around what you buy and when you actually buy that. And obviously, there is some element of rules-based to that, so you do have a lot shorter trades.”

Another factor shortening holding periods is the evolution of retail trading platforms.

“If you look at what’s available today compared to what was available 20, 30 years ago, you now have these trading platforms that are completely intuitive and interactive,” he said.

“They have gamified trading. So, a lot of these trading platforms now, if you do a good trade, there’s like a little confetti animation, or you get an award. They’ve incorporated social media or social aspects. A lot of them allow you to watch what other people are trading, seeing who’s trading the best, follow them. You can interact with the other traders.”

Added to that is the influence of social media, where popular personalities can drive trading decisions.

“Stocks are a great example of that. All of these things have resulted in less barriers to trading, and obviously that means that people are trading a lot quicker.”

Kempen said these developments have contributed to a breakdown in the traditional price discovery mechanism.

“With less and less people doing fundamental research, actually looking at the valuation of companies, the fundamentals of those companies, we think that that’s creating huge opportunities for active managers to generate alpha in the years to come.”

Active managers who continue to do the research and assess underlying company value may uncover undervalued or overlooked opportunities – positioning themselves to outperform the market and deliver excess returns for their clients.

Staying grounded amid change

Although change is constant, there are still a few enduring principles investors can rely on, said Kempen.

From Coronation’s perspective, their investment philosophy has remained consistent since the company was founded.

“It is a philosophy process that is based on valuation over the long term. And the one thing that we’re absolutely certain about is that you will see disconnects in pricing in the market. But ultimately, fundamentals are like gravity. People will pay for something based on what they are fundamentally worth at some point in time. And if you’ve got the patience to wait that out, you will definitely benefit.”

The second constant, Kempen said, is the importance of proprietary research.

“We don’t rely on third-party research. We do our own research. We go out there, we kick the tyres.”

The final principle is time. Patience, he emphasised, is critical to successful investing.

“And we always talk about the fact that the market is only interested in three years: last year, this year, and next year, whereas, from our perspective, we’re always looking at least five years or more out.”

Investing, in Coronation’s view, is a long-term game.

“It’s only if you’re patient that you actually capitalise on what we think of the only two free lunches in investing, which is compounding and diversification. And if you have these three things, we put them all together, ultimately, we think you will be rewarded. It has been borne out by the performance.”