Under fire: the risks reshaping short-term insurance in SA

Interconnected hazards are altering claims patterns and capital pressures for insurers – shifting priorities for brokers and corporate risk teams, says PSG Insure.

Interconnected hazards are altering claims patterns and capital pressures for insurers – shifting priorities for brokers and corporate risk teams, says PSG Insure.

Recent COIDA amendments overhaul workplace safety, claims, and compliance rules, creating new obligations for employers and expanded rights for employees.

Political risks and violence have reached their highest position in the Allianz Risk Barometer, reflecting rising concern over war perils, civil unrest, and sabotage.

With data breaches costing firms tens of millions per incident, Joint Standard 2 forces financial institutions to strengthen governance, monitoring, and incident response.

While local risk rankings align with global patterns, infrastructure fragility, business interruption, and cybercrime leave SA firms particularly exposed to cascading disruptions.

Small and mid-sized businesses face heightened AI risks, but targeted support from insurers and advisers can help bridge the gap.

Rapid, transparent claims processing and simplified policy wording are key to building trust. Firms that demonstrate protection consistently can contribute to a resilient market.

The Bill largely clarifies and strengthens existing AML/CFT expectations rather than introducing a new regulatory philosophy.

The Bill proposes that arrangements yielding outcomes similar to traditional financial products be treated as financial services.

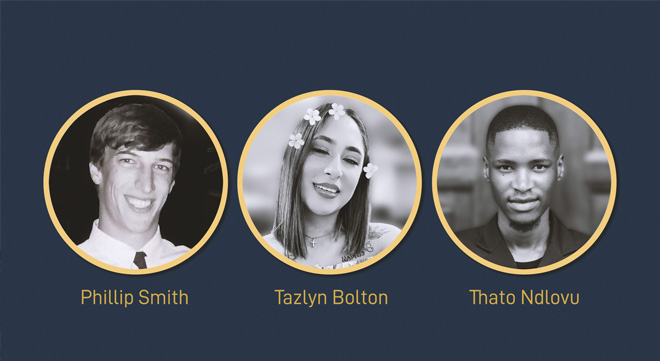

MBSE top achievers share how the HCSTI turns ambition and experience into long-term growth in short-term insurance.

A Northern Cape High Court ruling shows how easily advisers can be left personally exposed.

Momentum Insure’s chief actuary, Rudolf Britz, urges advisers to guide clients through an annual insurance review in January – a simple yet powerful step to protect goals, reduce worry, and enable financial growth.

Shifting storm patterns and intensifying events are reshaping agricultural risk and making robust crop insurance indispensable.

As South Africans turn to Airbnb, house swaps, and car rentals to cut costs, many discover personal policies don’t automatically respond.

The PPRA and LPC tighten enforcement as complaints surge over referral incentives, early commissions, and covert ‘gift economy’ deals.

Discovery Insure warns that inactive or faulty tracking devices may leave motorists without hijacking or theft protection.

Comprehensive industry input now will influence what data the FSCA collects and how it prioritises future enforcement and benchmarking.