Old Mutual to ‘re-enter’ retail banking space in 2024

The group unbundled its majority stake in Nedbank in 2018.

The group unbundled its majority stake in Nedbank in 2018.

Intermediaries can help clients to understand the implications of losing their protection.

He was alleged to have disrespected the CEO during a staff meeting called to address the team’s underperformance.

The FSCA has published a conduct standard setting out the requirements relating to third-party cell captive insurance business. Conduct Standard 2 of 2022 (INS) came into operation on 1 October and applies immediately […]

National Treasury and the South African Special Risk Insurance Association (Sasria) are working on ways for the state-owned insurer to reintroduce the R1 billion in additional cover for large corporates, Finance Minister Enoch […]

In an article about a case in which the High Court in Johannesburg ordered the South African Special Risk Association to pay Blackspear, the judge noted that, despite the complexity of the relevant […]

A few years ago, climate change was a far-off reality, but a marked increase in natural disasters and weather-related catastrophes points to the reality that it may be closer to home than we […]

In what is a rare win for an insurer in recent times, the Gauteng High Court’s judgment in Musa v King Price Insurance Co on 9 May highlights the importance of insureds abiding […]

If you think that a “business as usual” approach is all that is required in the future, you are in for a rude awakening. In a recent media release, Andrew Coutts, the head […]

The fallacy that insurance commission is the root of all evil has led to numerous failed attempts to regulate it. Dr Brian Benfield, a retired professor from Wits’ Department of Economics, holds nothing […]

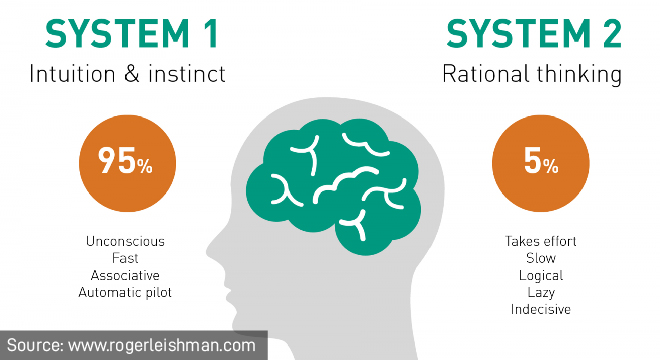

When it comes to finance, we assume people are rational, so we give people more information and longer documents and explain the actuarial principles in the hope that they will result in their […]

Clients often find insurance conversations challenging. They want to get through them quickly and enter them with a preconceived idea of what they want to talk about. But intermediaries can have more meaningful […]

The South African Special Risk Insurance Association (Sasria) has appointed Mpumelelo “Mpumi” Tyikwe as its new chief executive, effective 7 April. Outgoing incumbent Cedric Masondo, whose term ends in May, is set to […]

The FSCA says it will continue to ensure that insurers adopt “a fair and balanced approach” towards premium increases, while taking into account the valuable role the insurance industry has played in difficult […]

The question of full disclosure at the time of application, as well as during the term of a policy, came to the fore in a recent article published in Rapport. After first repudiating […]

Santam, South Africa’s leading non-life insurer, issued an “operational circular” on 15 March that could have a significant impact on commercial clients’ existing cover for business interruption resulting from extended cover for losses […]

Insurers are disputing or rejecting an increasing number of motor vehicle accident claims on the grounds that the insured was speeding, and consumers should be made aware of the implications of the reasonable […]