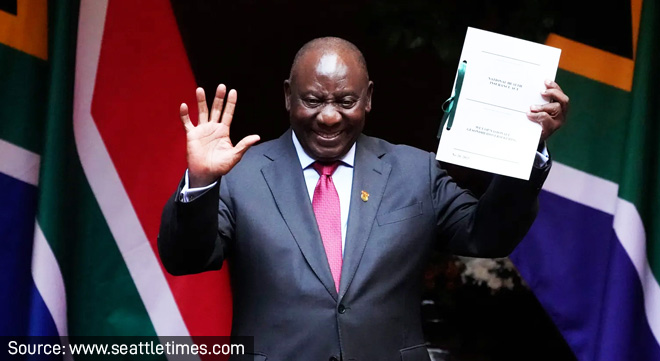

High Court: Minister’s power to set VAT rate is unconstitutional

The declaration of invalidity was suspended for 24 months and referred to the Constitutional Court for confirmation.

The declaration of invalidity was suspended for 24 months and referred to the Constitutional Court for confirmation.

The High Court finds Banxso knowingly benefited from deepfake adverts, misled clients about its licence and returns, and is ‘hopelessly insolvent’.

Medscheme’s bid to halt Bonitas’ administration transition has been delayed after procedural lapses and unresolved interlocutory issues forced the matter off the urgent roll.

Social media may feel informal, but legally it is still publication. And publication – if defamatory – can lead to court orders, retractions, and substantial legal costs.

The judgment also reinforces that generic voetstoots clauses or poorly explained limited warranties cannot waive statutory rights under the CPA.

The High Court rejects arguments that excess transactions processed during a system error amounted to unlawful credit extension.

The High Court overturns an earlier disallowance of the curator’s costs and reaffirms that former trustees remain personally liable for curatorship and inspection expenses.

The High Court voids the deregistration of Veritas Capital Africa, allowing HGG’s liquidators to pursue the recovery of R20.49m allegedly transferred before its collapse.

The Supreme Court of Appeal confirms that 181 unchallenged court orders obtained by Sunshine Hospital remain enforceable.

The summons argues the NHI Act limits patient choice, centralises provincial health functions, and lacks sufficient financial and institutional feasibility.

The judgment delivers a warning to directors: act as your own lawyer without court approval, and your case may be struck out with costs.

The judgment clarifies that when a taxpayer offers over-collateralised security and SARS cannot explain real risk, suspension should follow.

A signed nomination received during the policyholder’s lifetime satisfied the contractual requirements despite an incorrect policy number.

The Western Cape Division holds that affixing a summons does not automatically satisfy the amended service rule in default judgment applications.

Internal directives cannot displace court orders or long-standing principles governing compensation, says the Western Cape High Court.

The case focuses attention on how the exchange control framework applies to crypto platforms that facilitate offshore trading through loans.

The CMS frames the judgment as necessary to protect members, emphasising the scheme is compliant, operational and under close oversight.