Last call for accessible FAIS-aligned entry qualifications at MBSE

With applications closing on 15 June, MBSE’s FETC NQF 4 programmes offer a final chance to secure recognised FAIS credits before more restrictive replacements take effect.

With applications closing on 15 June, MBSE’s FETC NQF 4 programmes offer a final chance to secure recognised FAIS credits before more restrictive replacements take effect.

The changes include the increase in the annual tax-deduction cap, and new annuitisation and living annuity commutation thresholds.

From CGT thresholds to small business tax and foreign allowances, Ronald King identifies the changes that could materially reshape financial plans.

A signed nomination received during the policyholder’s lifetime satisfied the contractual requirements despite an incorrect policy number.

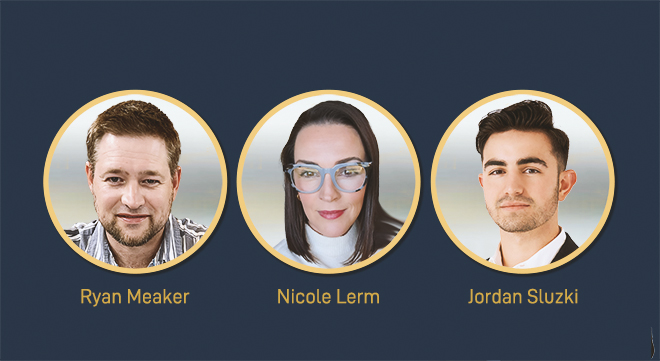

Top achievers share how MBSE’s Higher Certificate in Wealth Management translates knowledge into real-world confidence.

RAs and living annuities usually fall outside the deceased estate, which means the proceeds will not be tied up while the estate is finalised.

From no-fee schools to R200 000-plus private options, rising education costs are forcing families to budget smarter, plan earlier and rethink how they fund schooling without sinking deeper into debt.

Disciplined planning, clear governance and early education – not asset size – are what determine whether wealth survives across generations.

Balancing ‘Black Tax’ with your own financial security is possible through clear boundaries, strategic planning, and professional guidance.

From a shipbuilding director to a career-changer at 40 and a junior adviser navigating cross-border portfolios, MBSE’s Advanced Certificate in Financial Planning equips diverse professionals with confidence.

Momentum Insure’s chief actuary, Rudolf Britz, urges advisers to guide clients through an annual insurance review in January – a simple yet powerful step to protect goals, reduce worry, and enable financial growth.

Top achievers from Moonstone’s Postgraduate Diploma in Financial Planning show how the programme builds professional judgement, technical depth, and career clarity.

Don’t wait for New Year’s resolutions – build or refresh your competence in financial services with MBSE’s nine COB modules.

Marketing and reputation experts urge financial planners to build an authentic online presence to counter misinformation.

MBSE’s free Virtual Open Days from 11 to 13 November offer aspiring and established finance professionals a chance to explore accredited qualifications, engage with lecturers, and map out their next academic step.

Here are all the award-winners announced at the Financial Planning Institute’s gala dinner on Monday night.

The new Integrated Regulatory System will deliver a single, unified view of entities and support an activity-based supervisory model aligned to COFI’s principles.