Classic Financial’s Geldenhuis in court after four-year wait, first LDA lodged

Classic Financial Services edges closer to closure as the first liquidation and distribution account is formally lodged for public inspection.

Classic Financial Services edges closer to closure as the first liquidation and distribution account is formally lodged for public inspection.

Treasury’s R2.2bn intervention ends an 11-month account freeze, unlocking payouts for Ithala’s 257 000 depositors while the liquidation case continues.

The judgment dismissed parts of Sasfin’s exceptions and left SARS’s statutory claim under the Financial Sector Regulation Act to proceed.

The High Court says the state-owned financier must comply with deposit controls while awaiting the Supreme Court of Appeal’s ruling.

The repayment administrator and the Prudential Authority appealed a High Court ruling that allowed Ithala to continue operating while liquidation proceedings are pending.

The FSCA has provisionally withdrawn Nessfin’s licence amid concerns over its ties to unauthorised entity MyWealth Legatus and potential breaches of financial sector laws.

The proposed CEO breached the Companies Act by allowing another company of which he was the sole shareholder to advance loans to him while it was insolvent.

After months in limbo, Ithala resumes limited operations – but its revival faces steep legal and regulatory challenges as the battle over its liquidation and banking status intensifies.

Ithala has been cleared to resume core operations – excluding deposit-taking – while legal battles over its liquidation and frozen R2.47bn in deposits continue.

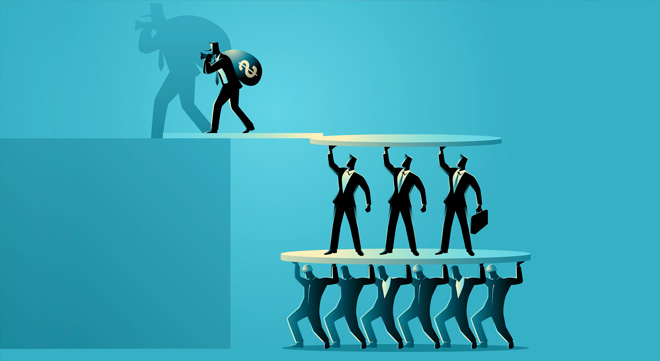

Five investors sought to recover their money, but the High Court ruled their funds were part of an illegal operation and must be forfeited to the state.

As the KwaZulu-Natal government scrambles to keep Ithala afloat, its urgent request for a R2.4 billion loan from National Treasury sparks confusion – especially given an earlier government guarantee.

A PA-commissioned solvency report questions Ithala’s financial health, raising concerns about its equity, loan book, and potential shortfall in repaying depositors.

Ithala accuses the appointed repayment administrator of overstepping his authority, while the Prudential Authority moves to liquidate the entity.

The Prudential Authority’s push for Ithala’s provisional liquidation has brought the bank’s journey to an abrupt halt, leaving 257 000 depositors in limbo.

The Authority has agreed to reconsider the penalties it imposed on ‘Coenie’ Botha, the founder of Coin Based Innovation Global.

The High Court places the estate of Adelaide Musa Duma under provisional sequestration for her role in TVI, once SA’s biggest pyramid scheme.

The bank also faces a R4.9bn claim arising from SARS’s alleged inability to collect taxes and penalties from former foreign exchange clients.