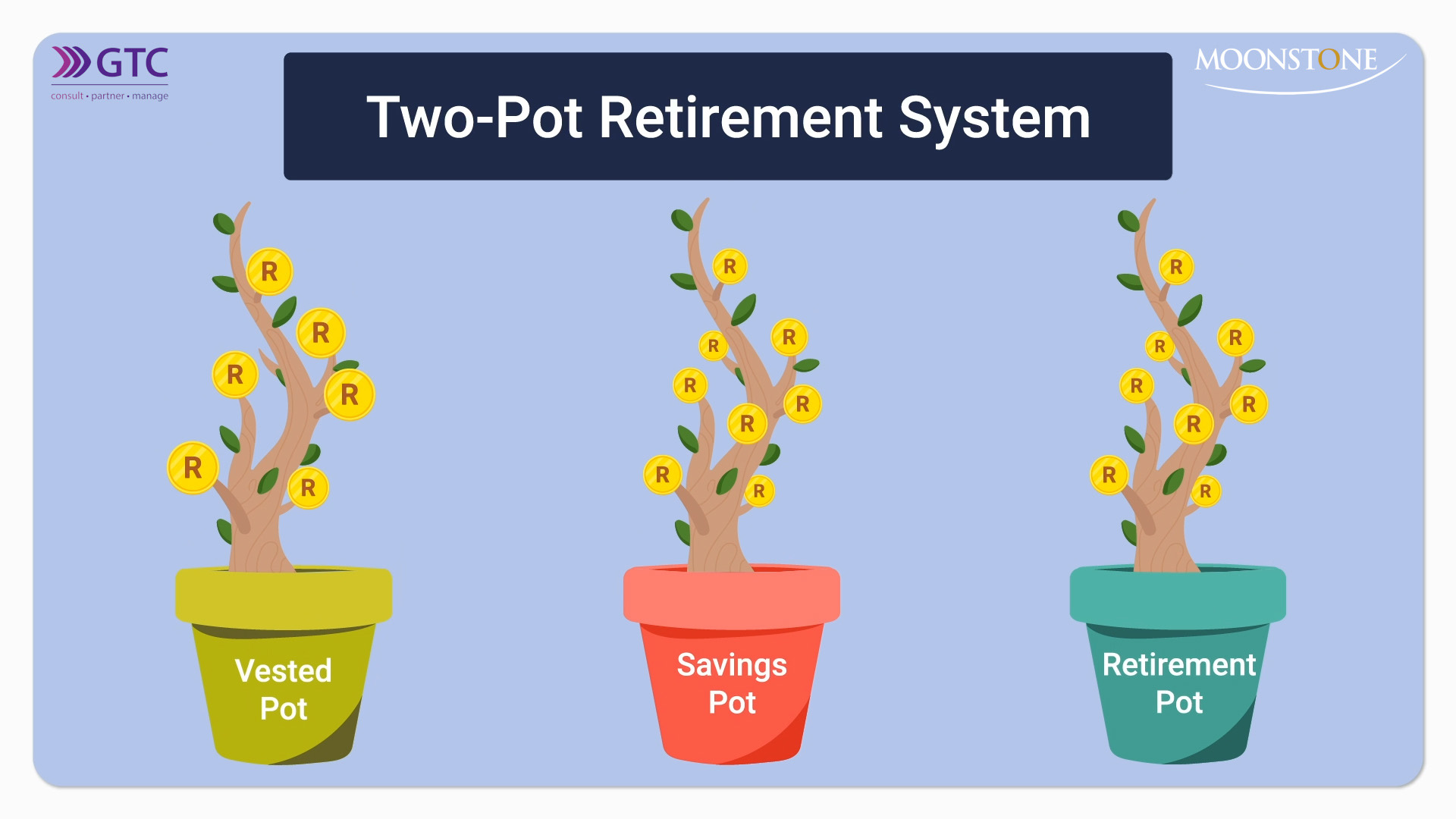

‘Two-pot system will produce better outcomes for those who avoid the risks’

The type of fund to which a member belongs may improve or undermine the preservation of retirement fund assets, says Allan Gray.

The key to a successful dividend strategy is identifying firms that wisely reinvest in growth while maintaining manageable payout ratios.

The type of fund to which a member belongs may improve or undermine the preservation of retirement fund assets, says Allan Gray.

The FSCA says prescribed assets will compromise the fiduciary duty of retirement fund trustees.

The syndicate gained unauthorised access to two accounts belonging to a German national on multiple occasions.

Public Compliance Communication 59 has been issued following two rounds of public consultation.

The US economy is giving off mixed signals, and the big question is whether it will slip into a recession or manage a soft landing.

The man persisted with his abusive emails despite being found in contempt of court twice and being sentenced to a period of direct imprisonment.

The 2023 FPI Financial Planner of the Year reflects on her career and shares some advice for young professionals entering the industry.

It is accompanied by three brochures that unpack different aspects of the two-pot system in more detail.

The draft Taxation Laws Amendment Bill addresses a critical anomaly in trust anti-avoidance legislation. By narrowing the transfer pricing exemption, the Bill ensures that only the correct portion of cross-border trust loans escapes double taxation.

The house, which belonged to the broker’s brother, was set alight after the sheriff served an eviction letter on the occupant.

High Court hands down a decision on the interpretation of the tracing provision in section 37C of the Pension Funds Act.

Aaron Motsoaledi wants to engage with with stakeholders who are in favour of universal health coverage but have objections to the NHI Act.

As the two-pot retirement system goes live on 1 September, intermediaries must prepare to guide clients through the new structure.

A recent study by Schroders and Ad Lucem highlights significant challenges and opportunities for advisers to address the evolving needs of female clients.

The non-compliance was discovered during inspections by the Prudential Authority in 2020 and 2022.

The bank also faces a R4.9bn claim arising from SARS’s alleged inability to collect taxes and penalties from former foreign exchange clients.

Understanding how an excess works can help to strike a balance between minimising risks and saving on premiums.

Notifications