Minister can increase the fuel levy without parliamentary process

The Full Bench provides its reasons for dismissing the EFF’s attempt to halt the Minister of Finance’s decision to increase the general fuel levy.

The Road Accident Fund has withdrawn its challenge to the Auditor-General and accepted adverse findings.

The Full Bench provides its reasons for dismissing the EFF’s attempt to halt the Minister of Finance’s decision to increase the general fuel levy.

Business Unity SA is seeking a review of the employment equity targets, arguing they are substantively and procedurally irrational.

Initial post-election gains have unwound as global commodity and manufacturing momentum converged with the world rand.

CEO Jeanette Marais says Momentum will ‘invest aggressively in advice’ in its effort to strengthen VNB and long-term competitiveness.

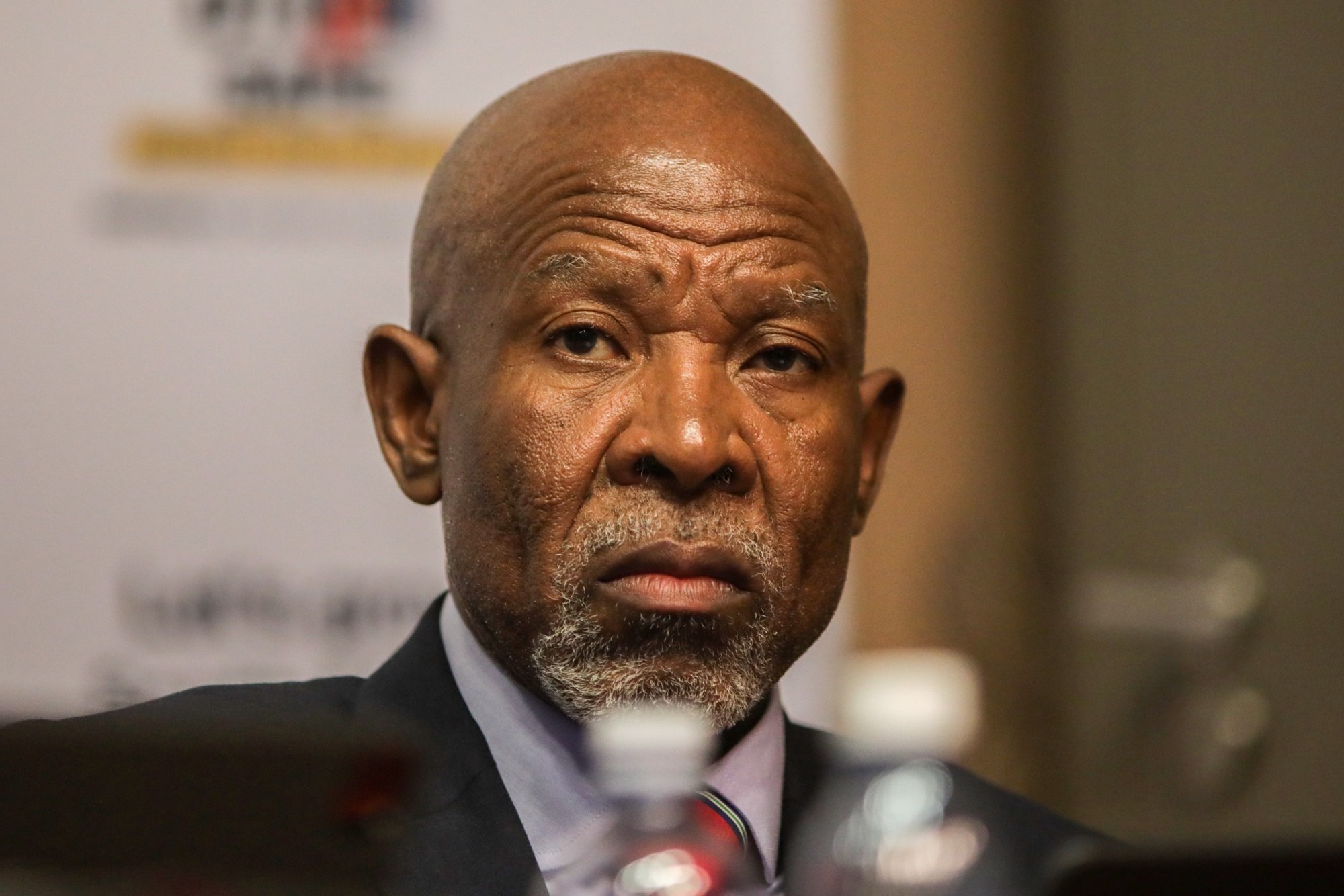

Governor Kganyago signals target reform ‘as soon as is practical’ while policymakers pause cuts.

ISASA says there has always been a distinction between exempt (educational) and taxable (commercial) supplies.

Until the suspensive condition is met, the right to performance is suspended and the prescription clock does not run.

A proposed amendment to the Income Tax Act will tax unit trust investors on capital distributions before disposals, without any base cost offset.

Business Partners’ Q1 2025 SME Confidence Index finds early-year optimism has been eroded – driven chiefly by budget uncertainty, a R75bn revenue shortfall and global volatility.

The judgment confirms that municipalities can be held legally responsible when known public dangers, such as an uncovered stormwater drain, lead to injury or death.

The proposed amendments will also see increases in the Tribunal levy and the FAIS Ombud’s charge per KI/representative.

Moonstone’s enhanced Self-Comply Service gives small FSPs and sole proprietors even stronger compliance support, including dedicated consultants, customised plans, and proactive monitoring.

Employers, banks, insurers, and other identity-verifying bodies must accept surname assumptions by any spouse and update onboarding and benefits procedures accordingly.

Kickstart your career with MBSE’s accredited online qualifications – from certificates to its new future-ready BCom degree.

Despite a 20% drop in the value of new business, Momentum’s annuity earnings remain strong and underlying profitability resilient, lifting normalised headline earnings 41%.

Financial institutions subject to Joint Standards 1 of 2023 and 2 of 2024 are asked to provide feedback by 5 October 2025.

Advocate John Simpson publishes his Office’s draft budget for public comment.