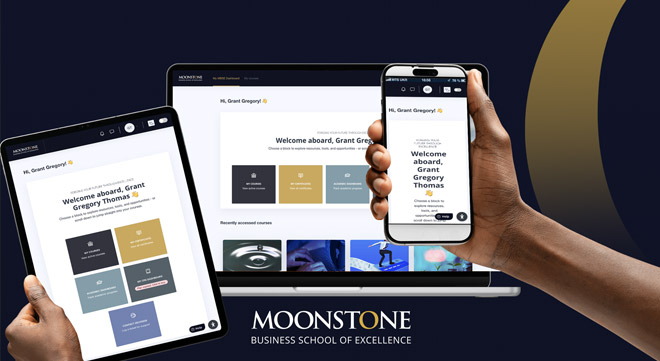

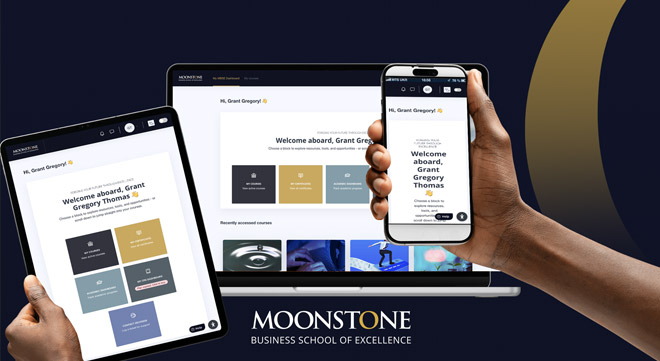

One click to learning: MBSE introduces progressive web app

Students can now access MBSE’s courses and materials with a single click from desktop or mobile, enjoying seamless, on-the-go learning without opening a browser.

The Tribunal dismisses separate applications brought by Banxso and four executives, saying they lack legal standing.

Students can now access MBSE’s courses and materials with a single click from desktop or mobile, enjoying seamless, on-the-go learning without opening a browser.

The first edition of our new series unpacks the types of medical plan, who they suit, and why the cheapest option isn’t always the smartest choice.

The funeral provider has faced repeated determinations this year after failing to settle valid claims.

The code sets out how dismissals must meet substantive and procedural fairness requirements.

The Authority signs an agreement with SABRIC and the Southern African Fraud Prevention Service to enable a faster system-wide response to scams.

Results from operations rose 16% to R4.94bn in the six months to June, boosted by a 71% surge in Old Mutual Insure’s contribution.

The FSCA also cautions against dealing with Hlalani Rocken Nkuna, who markets trading signals but is not authorised.

Industry stakeholders say poorly consulted proposals risk undermining investment, savings, and innovation.

Proposed amendments could undermine the tax-efficient compounding that makes a collective investment scheme an attractive investment vehicle.

The curator will assess Sizwe Hosmed’s finances and recommend whether it should merge, be liquidated, or continue.

The client initially swore to non-consent, but in a second affidavit he said drugs clouded his memory, insisting he was present when the policies were initiated.

Remuneration extends beyond cash payments – products, services, and travel perks must also be declared as taxable income.

The net result from financial services grew by 20% to about R8.08bn, with general insurance the standout in the six months to the end of June.

DTAs shape the taxation of lump sums and annuities. This is what financial advisers can do to preserve clients’ retirement benefits.

Standard Insurance’s five-year analysis discloses the main perils affecting businesses and households, and when and why policyholders are most likely to claim.

The Council for Medical Schemes recommends capping 2026 contribution increases at 3.3% plus “reasonable utilisation estimates”, yet past trends show schemes often push far higher.

New criteria require closer supervisory scrutiny of DNFBPs on market entry, ongoing oversight, and high-quality suspicious-transaction reporting.