Corporate bonds are probably one of the most ignored asset classes, specifically among individual investors. However, their inclusion in a multi-asset investment portfolio can significantly enhance returns. The United States is probably the most liquid corporate bond market in the world.

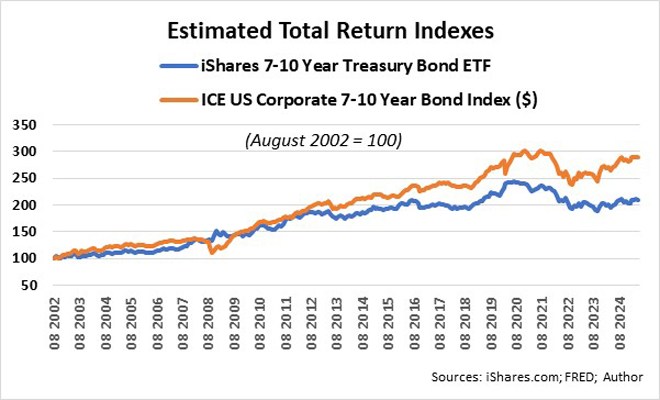

Over time, US investment-grade corporate bonds have produced superior returns relative to US treasury bonds with similar durations. Since August 2002, the ICE US Corporate 7–10-year Bond Index has returned 4.8% with income and dividends reinvested, while the iShares 7–10-year Treasury Bond ETF (a proxy for the US 7–10-year treasury bond index) delivered 3.3% a year.

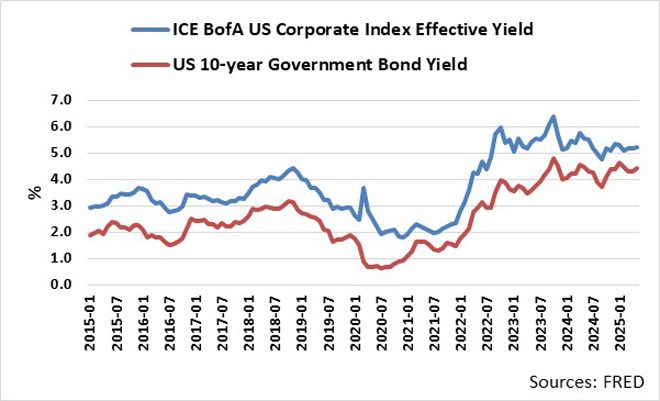

The outperformance can mainly be attributed to the higher effective yield to maturity of corporate bonds. Because of the higher perceived credit and liquidity risk, companies need to offer higher interest rates than lower-risk government bonds to attract investors. In addition, the effective yields of corporate bonds tend to reflect the yield to maturity of US treasury bonds with similar durations.

Optimum combination of US investment-grade corporate bonds and US government bonds

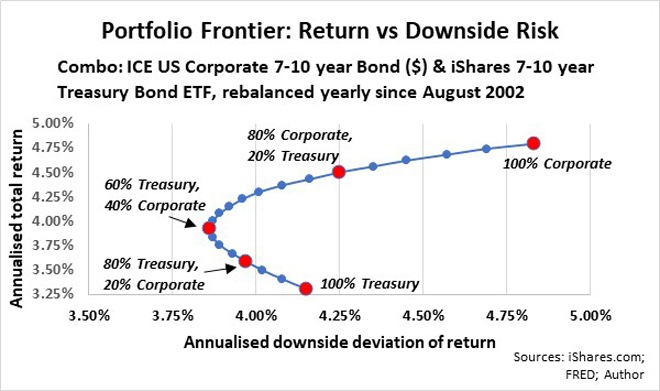

My calculations of the optimum structure of a portfolio consisting of a combination of US corporate and US government bonds with similar durations are based on the total returns (income reinvested) and downside risk of the iShares 7–10-year Treasury ETF and ICE US Corporate 7–10-year Bond index, where downside risk is the downside deviation of returns: therefore, focusing only on bad volatility since August 2022.

The calculated optimum portfolio frontier is a ratio of 60% government (treasury) bonds and 40% investment-grade corporate bonds, where I am likely to get the highest return given a level of risk.

The underlying capital risk in US corporate bonds relative to their government bond peers is, however, the behaviour of the US stock market.

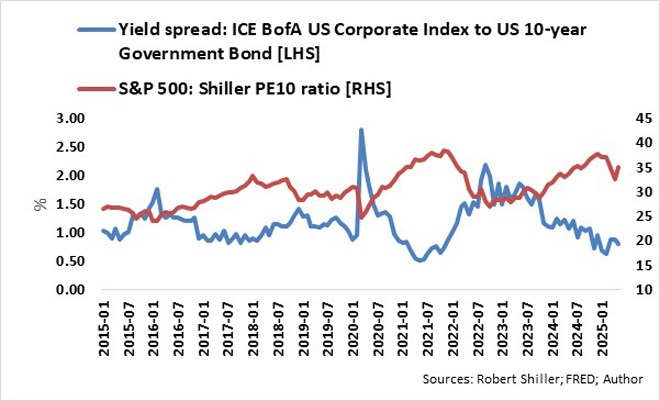

Although the relationship (correlation) between the US corporate bond price index and the US stock market as measured by the S&P 500 index is relatively weak, the yield gap between corporate bonds and the benchmark US 10-year treasury bond yield is highly correlated to the valuation of the S&P 500 index as measured by Robert Shiller’s PE 10 ratio, which is based on the average inflation-adjusted earnings from the previous 10 years.

The yield spread between corporate bond declines at times of a strong equity market (rising PE10 ratio or re-rating), and it bottoms when the stock market peaks. Conversely, the yield spread increases during stock market sell-offs (declining PE10 ratio or de-rating) and peaks when the stock market bottoms. Investors tend to hedge their positions against capital and default risk through positions in stock and derivative exchanges.

Over the past 20 years, except during the Global Financial Crisis in 2008 when the yield spread widened to 550 basis points, the yield spread has traded between 30 at its best and 200 basis points at its worst. With the spread currently at 77 basis points, it seems that US corporate bonds are priced for perfection relative to US 10-year treasury bonds and reflect the current elevated stock market valuations as measured by the PE10 of the S&P 500.

Yes, corporate bonds need a strong equity market to maintain the current low yield spread to US treasuries. Any Black Swan event that may have serious global liquidity implications could lead to a significant jump in corporate bonds’ yield spread to US 10-year treasuries.

When investing in corporate bonds, I prefer investment-grade exchange traded funds to get exposure to a broad basket of corporate bonds and to reduce the risk of defaults and have immediate liquidity.

Considering that the yield spread is approaching historical lows, I prefer US government bonds ahead of US investment-grade corporate bonds.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

I disagree that the 60% treasury & 40% corporate bond ratio is the optimum portfolio. The Portfolio Frontier graph shows that an optimum portfolio could be anywhere between 60% treasury (so 40% corporate) and 100% corporate, depending on the risk tolerance of the investor, while any portfolio with more than 60% treasury would obviously definitely not be optimum, since the investor would get a lower expected return for a higher risk. The 60% treasury (40% corporate) portfolio would only be optimum for a very highly risk averse investor, while increasing the corporate bond share slightly above 40% (eg to 50%) causes a fairly high increase in expected return for only a tiny increase in risk. Finally, volatility (measured by downside deviation) is being used as a proxy for risk, because volatility is easier to measure, but volatility does not give an accurate indication of risk (except possibly for short term investors), because it excludes the risk effects of unlikely but devastating Black Swan events and also ignores that the distribution of returns is unlikely to be a normal (Gaussian) distribution). However, downside deviation is still a big improvement over ordinary standard deviation.