Investors across the world are showing renewed interest in equities, according to Schroders’ 2025 Global Investor Insights Survey. The annual survey gathers the views of institutional investors such as retirement funds, insurance companies, and family offices. This year’s results suggest cautious optimism, with many turning back to public and private equities after a period of uncertainty.

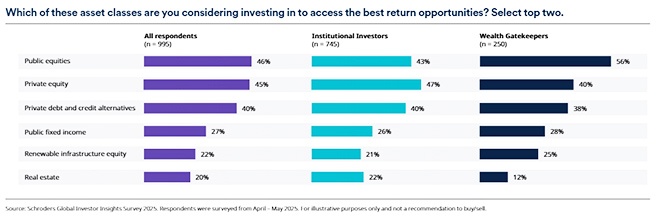

The survey’s findings show that equities are the most popular asset class for generating returns, despite recent market turbulence. Nearly half of the respondents (46%) chose public equities as their top choice, closely followed by private equity at 45%. Schroders said this trend reflects a renewed focus on agility and diversification.

“In a market that’s anything but predictable, investors are turning to what they know: public equities. Not out of habit, but because they offer the agility and global reach needed to navigate complexity and capture performance,” said Alex Tedder, Schroders’ chief investment officer for equities.

Risk appetite slowly returning

According to Philip Robotham, Schroders’ head of wealth in South Africa, there has been a noticeable change in risk appetite.

“While 41% are maintaining their current risk exposure, 21% are increasing it – indicating a measured shift in sentiment rather than inertia,” said Robotham.

Equities remain the leading choice for return generation over the next 12 to 18 months.

Robotham said this shows growing conviction in the long-term potential of the asset class.

Credit-based strategies gaining ground

The survey also found that credit-based investment strategies are becoming more mainstream. About 40% of respondents included private debt, direct lending, infrastructure debt, or securitised products in their top three choices for returns. Robotham said these are no longer niche options but core components of resilient portfolios.

Preferences differ depending on the type of investor. Wealth managers tend to favour public markets because of their liquidity and ease of access. In contrast, institutional investors are leaning more towards private markets, drawn by long-term potential and alternative governance structures.

Despite these differences, Robotham observed a clear shift in focus towards performance and diversification – with equities, particularly global equities, at the centre of many strategies.

Global equities preferred over US

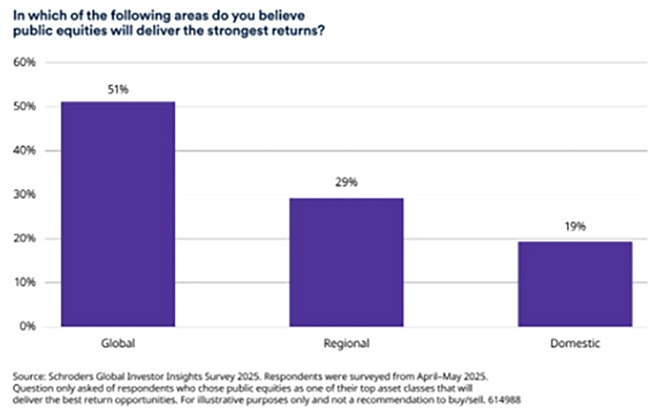

Among those choosing public equities for return potential, 51% picked global equities as their top option. Robotham said this shows a move away from the US-dominated strategies of recent years towards a more diversified global approach.

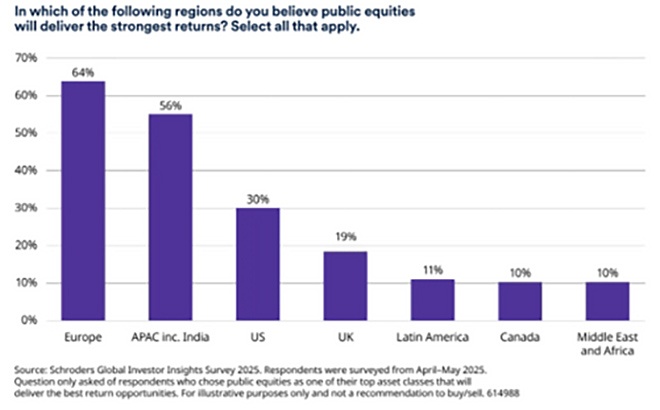

When asked about regional preferences, 29% of investors chose a regional focus, with Europe and Asia-Pacific (APAC) emerging as the top picks. The US still has support, with 30% citing it as their preferred region.

Robotham noted that several recent events may have influenced this shift. For example, trade tariffs introduced by the US earlier this year caused market disruptions, while China’s low-cost AI technology, DeepSeek, stirred volatility in January. These developments challenged the perception that US tech stocks are the safest bet.

According to Robotham, some investors are revisiting regions they previously ignored. European equities, for instance, have gained attention because of new investment plans from Germany’s coalition government.

Tedder explained it this way: “The only bet you needed to make in the last 10 years was to own the US, whereas now if Europe and Asia are getting incrementally better (admittedly off a low base), and the US is getting incrementally worse, then underlying asset flows will continue to shift towards those regions.”

Active strategies gain favour

The survey also found a strong preference for active management. Among those investing in public equities, 53% favour active strategies, and 37% prefer a mix of active and passive. Only 10% rely solely on passive investment.

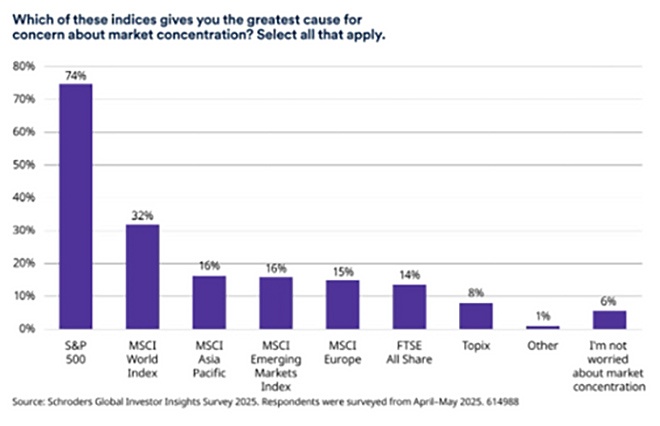

Robotham said concerns about index concentration – particularly in the US – are driving this trend. Only 5.5% of investors said they were not concerned about market concentration. Most cited the heavy weighting of large-cap US tech stocks in global indices as a key risk.

He explained that passive investors tracking benchmarks such as the MSCI World Index, which currently has 72% exposure to US equities, might be overexposed to the same handful of tech giants. Actively managed global strategies, by contrast, can seek out opportunities in regions and sectors that passive funds might overlook.

Mid-cap and large-cap equities seen as resilient

The data also shows that investors favour companies of all sizes. Although large caps are still seen as the most reliable, with 57% of support, mid-caps are not far behind at 51%. Robotham said this reflects a desire to reduce dependence on US mega-caps and seek opportunities across the full spectrum of market capitalisation.

Tedder summed it up: “In an increasingly complex investment landscape, it’s clear that global investors still see public equities as a compelling source of long-term returns. Their renewed confidence – reflected in increased interest in active strategies – speaks to the critical role of agile, forward-looking equity management in navigating concentration risks and capitalising on growth trends.”

Click here to read the full Schroders Global Investor Insights Survey 2025.

Disclaimer: The views expressed in this article are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investor advice that is appropriate for every individual’s needs and circumstances.