The outgoing acting FAIS Ombud, Advocate Nonku Tshombe, released her office’s annual report for the year to the end of March 2022 on Friday.

Here are eight things the report tells us about the office’s activities during the 2021/22 financial year.

1. Most new complaints in a year since the office’s inception

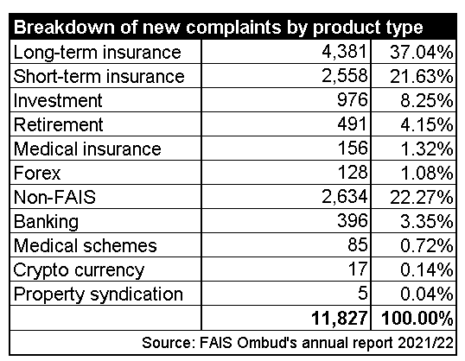

In 2021/22, the ombud’s office received the highest number of new complaints in a financial year since the office was established in 2002. The office received 11 827 new complaints, compared to 10 552 in 2020/21.

In addition, an “unprecedented” number of complaints received fell within the office’s mandate. This resulted in 8 011 complaints being referred to the office’s case management department for investigation, which was the most since the office’s inception and a “significant” increase from the 6 975 in 2020/21.

2. Most complaints were dismissed or sent on

Of the 11 827 new complaints received in the 2021/22 financial year, 4 957 (42%) were dismissed, and 3 791 (32%) were referred to alternative dispute resolution fora.

Tshombe said the dismissal of complaints is considered only after significant due diligence has been undertaken during the investigation, and her office is required to provide detailed reasons for dismissing a complaint.

The number of complaints settled, 1 269 (11%), was less than the 1 389 complaints settled during the 2020/21 financial year.

The number of new complaints received during 2021/22 that were carried over to the next financial year was 1 810 (15%), which was lower than the 2 041 carried over during the previous financial year, despite the significant increase in the number of complaints received.

As a result, 10 017 new complaints (11 827 – 1 810) were resolved within the financial year, which represents 84.7% of all new complaints received. Tshombe says this means her office achieved its strategic outcome to resolve a minimum of 80% of all complaints received within a specific financial year.

On average, 84.05% of all complaints received by the office were resolved within three months, 88.77% within six months, and 95.68% within nine months.

3. Ratio of complaints settled in favour of consumers fell

Overall, the office resolved a total of 12 089 complaints in 2021/22, which, the ombud said, was the most during a single financial year. Of these, 6 314 (52%) were dismissed and 3 947 (33%) were referred to other fora.

Of the total complaints resolved, 1 823 (18%) were resolved by way of a settlement, which was an increase on the 1 729 resolved in favour of complainants during the previous financial year. The ombud issued only five determinations in 2021/22.

Despite this increase, the office’s settlement ratio of 22% was lower than the 27.59% in 2020/21. Tshombe said this was because a larger number of complaints were dismissed after an initial investigation found the complaint had no basis or merit.

“This is an indication of the economic impact of the post-pandemic environment and the subsequent desperate situation faced by many complainants whose complaints revealed that there was a bigger change in circumstances as opposed to the inappropriateness of the advice provided at inception,” she said.

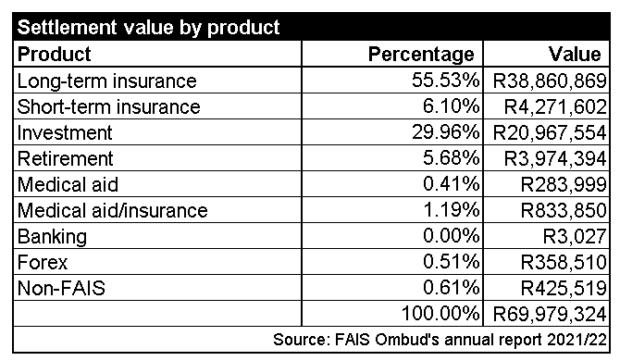

4. But the settlement value was the highest to date

The overall settlement value for the 2021/22 financial year was R69 979 324, which was the highest value returned to consumers recorded by office during a financial year.

Tshombe said it was laudable that most of this amount was the result of informal settlements achieved via conciliation processes between FSPs, consumers and her office.

The table below provides a breakdown of the settlement amount by product.

5. Tribunal dismissed most reconsideration applications

Any party that feels aggrieved by decisions taken by the ombud’s office can approach the Financial Services Tribunal (FST) for the matter to be reconsidered.

During the 2021/22 financial year, 158 applications for reconsideration were made to the FST. Of the 145 applications decided on as of 31 March 2022, 136 were dismissed and only nine were referred back to the ombud’s office for further investigation. The ombud said this reflected “a favourable rate of agreement with the tribunal”.

6. Backlog of property syndication complaints remains

The ombud’s report pointed out that the figures detailed above do not include complaints in respect of property syndication schemes. The office has ring-fenced the stats about these complaints.

Tshombe said her office made a commitment in 2021/22 to reduce the original number of 1 300 active property syndication complaints by at least 10% annually. By the end of March 2022, it was able to reduce this number to 1 004, a reduction of 3.09%. The report did not provide a reason for missing its target.

7. Office received an unqualified audit (with findings)

The office received an unqualified audit from the Auditor-General. The audit did not identify any fruitless or wasteful expenditure. However, it did identify irregular expenditure of R481 790, which was the result of a service provider’s contract being extended without following the relevant procurement processes.

Irregular expenditure of R7 962 443 was carried forward from the 2020/21 financial year, most of which related to the expenses incurred in leasing the office’s previous accommodation, which was not procured through a competitive bidding process.

National Treasury condoned the contract for leasing the office premises after the ombud’s office followed and complied with the applicable processes, condoning R7 750 518 of the irregular expenditure carried forward from 2020/21.

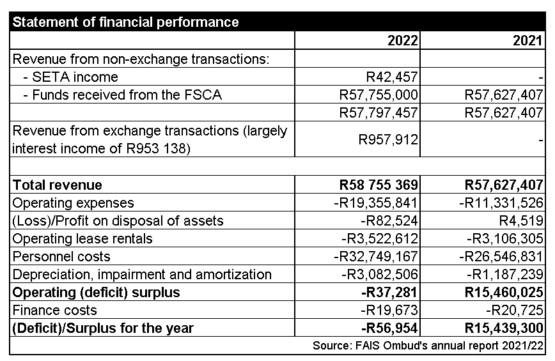

8. The office ended the year with an operating deficit

The office ended the 2021/22 year with an operating deficit of R37 281, and a net deficit of 56 954 after finance costs. The office ended 2021/21 with a net surplus of more than R15m.

One of the big contributors to the office’s higher operating expenses in 2021/22 was litigation fees, which increased by 175%, from R1 816 530 to R4 998 177.

As a result of the net deficit, the office’s accumulated surplus fell from R57 349 940 to R57 292 986.