Working South Africans’ confidence in the economy is at its lowest level since 2015, having fallen from 56% to 27% in 2023, according to the latest Old Mutual Savings & Investment Monitor (OMSIM).

This finding is hardly surprising, as consumers’ finances are battered by inflation, interest rates, and electricity blackouts. The fieldwork for this year’s Monitor was conducted between 5 April and 3 May when the country was experiencing some of the worst loadshedding on record. In addition to hitting consumers’ wallets directly (buying alternative energy solutions, food waste, damage from power surges), blackouts foster a generally negative outlook as jobs are threatened and the likelihood of a turnaround in the economy diminishes.

Interestingly, though, the overwhelming majority of the 1 518 respondents were optimistic that things would get better in the next six months. According to the survey, 71% held this view, only one percentage point lower than in 2022. Furthermore, the number of South Africans who are optimistic that things will improve “in the next six months” has been rising steadily, from 39% in 2017 to 61% in 2021.

Despite the financial pressure, the financial satisfaction level across all respondents was at 6.1 (on a scale of 1 to 10), which was 0.1 higher than it was last year and higher than it was in 2020 (5.3) and 2021 (5.9).

Fewer respondents reported feeling “high” or “overwhelming” levels of stress about their finances this year, with a total of 45% falling into these categories, down from 50% last year, and 56% in 2021.

Old Mutual released its latest Monitor last week. The OMSIM is based on research conducted among employed South Africans between the ages of 18 and 65 with personal monthly incomes of R8 000 to R99 999.

More interest in offshore investing

This year’s Monitor contains some insights into South Africans’ investment behaviour and risk appetite.

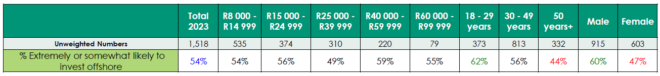

The percentage of respondents interested in investing offshore continued to rise, with 54% saying they were “extremely likely” (22%) or “somewhat likely” (32%) to invest offshore this year. This was up from 51% in 2021 and 50% in 2020.

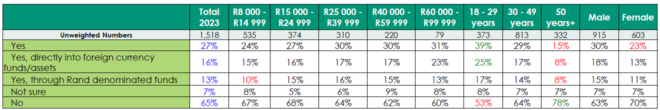

The percentage of respondents who said they have offshore holdings (directly or via rand-denominated funds) moved up to 27% from 24% last year.

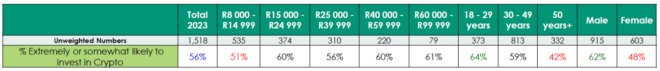

On the other hand, respondents’ interest in investing in cryptocurrencies waned: 56% said they were “extremely likely” or “somewhat likely” to invest in crypto, compared with 60% in 2022.

The percentage of respondents who said they had invested in cryptocurrencies fell slightly from 30% to 28%.

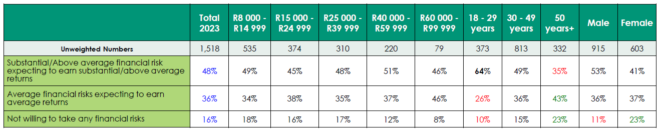

The number of people inclined to take substantial financial risk to earn substantial returns fell slightly in 2023, dropping to 21% from 23% in 2022.

Those prepared to take above-average financial risks for above-average returns also slipped, from 28% in 2022 to 27% in 2023.

Respondents prepared to take average risks to earn average returns grew from 31% in 2022 to 36% in 2023.

Those not willing to take any financial risks reduced to 16% in 2023 (2022: 19%).

As in previous surveys, investment risk appetite was strongly correlated with age and gender, with men and younger consumers significantly more willing to take on risk.

When it comes to investing in formal investment products, the results of this year’s survey are a mixed bag, but the overall picture is one of stability.

Some product categories recorded a slight increase compared with last year:

- Banked savings: 76%, up from 75%;

- Pension or provident fund: 64% (61%); and

- Endowment/savings/investment policies: 57% (56%).

But the following products saw a dip in investors:

- Retirement annuities: 51%, down from 53%;

- Listed shares (self- or broker-managed): 29% (30%);

- Unit trust funds or exchange traded funds: 27% (28%); and

- Education policies: 24% (26%).

Incomes eroded in real terms

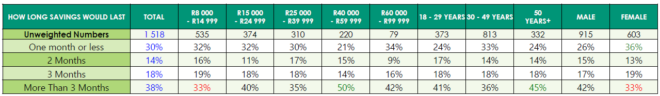

Only 38% (2022: 39%) of respondents said they have savings that will last them longer than three months if they were retrenched or lost their job. Of the 62% whose savings are sufficient for three months, 30% have enough savings for only one month.

One of the reasons South Africans are struggling to build savings buffers is that their incomes are being eroded by inflation.

The survey found that 70% of respondents were earning the same or less than they did three years ago, with 30% earning more now than before the outbreak of Covid-19.

Seventy percent is an improvement on the 79% who responded as such last year, but Old Mutual said inflation effectively means most working South Africans have less income in real terms.

To increase household income, South Africans are holding down several jobs, said Vuyokazi Mabude, the head of knowledge and insights at Old Mutual. This year’s survey classified 50% of respondents as poly-jobbers (the same as in 2022), with more young workers (18 to 29 years old) becoming part of this growing trend.

The number of young poly-jobbers rose from 60% in 2022 to 70% in 2023. Generally, however, these inflows were a minor portion of overall incomes earned, Mabude said.

Another challenge is that more respondents reported having to support family members.

The percentage of respondents caught in the “Sandwich Generation” (supporting children and parents and/or other older dependants) increased this year after falling to 39% in 2022. It’s back to where it was in 2021, at 43%.

After falling to 47% in 2022, the percentage of respondents supporting adult dependants rose to 50% this year – almost as high as the 52% in 2020.

The percentage of respondents supporting dependent children reached a new high of 79%, up from 78% last year.

Taking on debt to cope

Being “sandwiched” was not the only reversal of fortune experienced by respondents this year. Borrowing and dipping into savings also increased.

- 34% took out a personal loan in the last year, up from 27% in 2022 and double the 16% in 2020.

- 43% had to borrow money from family and friends, up from 40% in 2022 and almost as high as the 44% in 2021.

- 73%, up from 71%, used their bank credit cards.

- 61%, up from 57%, used store credit cards.

- 41%, up from 39%, used vehicle finance.

- 54%, up from 52% last year, dipped into their savings to make ends meet. This is the same percentage as in 2021.

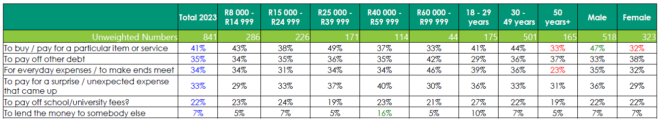

The main reasons respondents took out a loan were:

- To pay for an item or service (41% of respondents), such as servicing their vehicle, home improvements, transfer costs, and furniture and appliances.

- To pay off other debt (35%).

- To pay for everyday expenses or to make ends meet (34%). Contrary to what one might expect, this was the main reason for taking out a loan among those in top income band of R60 000 to R99 999 a month.

- To pay for an unexpected expense (33%), such as repairing or towing a vehicle, medical expenses, a funeral, home maintenance, and repairing an appliance.

- To pay off school or university fees (22%).

- To lend the money to somebody else (7%).

Most respondents (54%) were confident they could manage their debt, and 16% believed they could take on more debt and manage their finances well. But 24% said they have too much debt and were having “some trouble” managing it, while 6% said they have “far too much debt and cannot cope”.

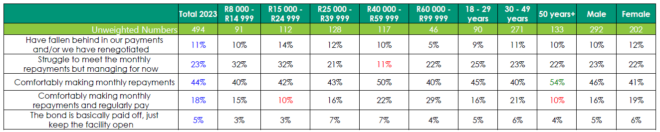

Looking at home loan repayments, 44% of respondents said they were “comfortably” making their mortgage bond repayments, and 18% said they were making the repayments and paying in extra every month. But 23% said they were struggling but “managing for now” to make their repayments, and 11% had fallen behind with their payments and/or had renegotiated the terms of their bond.