What medium and large administrators are charging for savings ‘pot’ withdrawals

Administrators may be in for a ‘windfall’ of R500 million to R1 billion a year in future tax years, says Keystone Actuarial Solutions.

Administrators may be in for a ‘windfall’ of R500 million to R1 billion a year in future tax years, says Keystone Actuarial Solutions.

This video explains the essential features of Moonstone Business School of Excellence’s new comprehensive RE 5 training.

In this video interview, Rudolph Geldenhuys, the FPI Financial Planner of the Year, shares how financial planning goes beyond technical expertise.

One of its four proposals is to allow members to transfer up to a third of their vested savings to their savings component.

Motsoaledi insists that equalising healthcare shouldn’t be held back by funding concerns, and he challenges the assumptions behind the cost estimates.

Following its recent R6.5bn acquisition of Assupol, Sanlam wants to expand its footprint in the financial services industry with a 25% stake in ARC FSH.

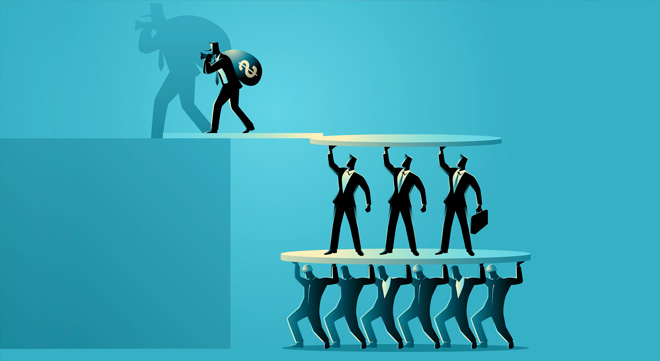

The High Court places the estate of Adelaide Musa Duma under provisional sequestration for her role in TVI, once SA’s biggest pyramid scheme.

The Tax Ombud is investigating SARS for potential service failures in addressing eFiling hijacking, with a review under way to uncover systemic issues.

At the FSCA Financial Education Summit, industry leaders outlined the shortcomings of current financial education efforts and the need for a strategic overhaul.

The NCC has prioritised the second-hand motor vehicle industry due to the high volume of complaints from dissatisfied consumers.

The group attributed the turnaround in motor insurance to managing claims inflation and improving risk selection, resulting in a significant reduction in claims frequency.

The leading independent benchmark for customer experience is a localised strategic measure that directs and supports leadership decisions on customer relevance.

With women taking on disproportionate caregiving roles, the elusive work-life balance seems harder to achieve. PSG executives share practical tips on how to simplify, organise, and prioritise to regain control.

South Africa has the potential to boost its savings rate and secure a more stable source of funding for fixed investments, essential for driving economic growth.

The government takes banks to task over what it sees as unfair lending practices, proposing mandatory disclosures of declined home loans.

Alexforbes is enhancing its relationships with independent advisers through targeted partnerships and a focus on building trust and value.

A municipality’s responsibility for road maintenance does not automatically make it liable for failing to meet that duty.