FSCA issues multiple public warnings about unauthorised operators

South Africans should verify anyone offering financial services or investment opportunities.

South Africans should verify anyone offering financial services or investment opportunities.

The comment comes amid a growing standoff between organised labour and GEMS after the scheme announced a 9.8% contribution increase for 2026.

The Office of the Tax Ombud is seeing the same delays, verification snags, and procedural irregularities highlighted by a tax practitioner.

Historical trends suggest it could take up to three years for some sectors’ price-to-book ratios to normalise, says Ryk de Klerk.

Iwan Schelbert admitted to his role in generating a fraudulent invoice that helped to inflate Steinhoff at Work’s accounts.

The National Consumer Tribunal rules the dealer breached the Act by leaving serious defects unrepaired – rejecting its disclaimers and partial fixes.

Taxpayers challenging assessments in transfer pricing disputes face hidden risks, including the rare possibility that the Tax Court could consider increasing an assessment.

In Circular 48, the CMS signals tougher enforcement against exempted insurers, warning that non-compliant branding and failure to notify regulators will attract decisive action.

South Africa’s removal from the EU’s high-risk list eases regulatory friction, but economists caution that rebuilding investor confidence will be gradual.

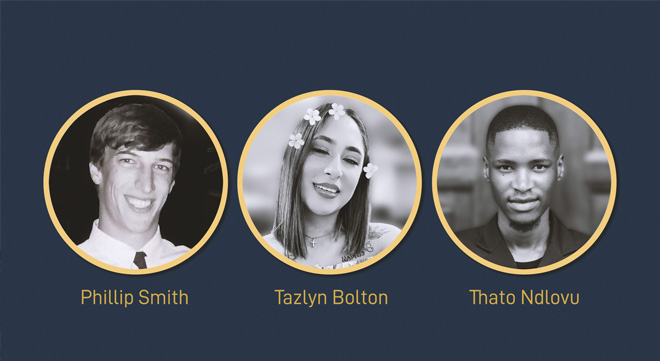

MBSE top achievers share how the HCSTI turns ambition and experience into long-term growth in short-term insurance.

Behind the viral humour lies a deeper story about geopolitics, energy risk and why disciplined, diversified investing could define returns as markets head into a potentially “Goldilocks” 2026.

From no-fee schools to R200 000-plus private options, rising education costs are forcing families to budget smarter, plan earlier and rethink how they fund schooling without sinking deeper into debt.

Disciplined planning, clear governance and early education – not asset size – are what determine whether wealth survives across generations.

Discovery Health has abandoned recovery action against more than 16 500 members, agreeing to absorb up to R170 million in overpaid ATB claims after sustained pressure from MediCheck,

A Northern Cape High Court ruling shows how easily advisers can be left personally exposed.

The High Court confirms that evidence from confidential arbitration can be disclosed in related South African litigation, forcing insurers and other parties to rethink how they manage arbitration materials.

Many employees know how much they are contributing but not whether it will deliver a sustainable income.