Twins born from donor sperm outside marriage not legal dependants

Sperm does not a father make and being a biological parent does not confer absolute rights, according to a ruling by the Pension Funds Adjudicator.

Sperm does not a father make and being a biological parent does not confer absolute rights, according to a ruling by the Pension Funds Adjudicator.

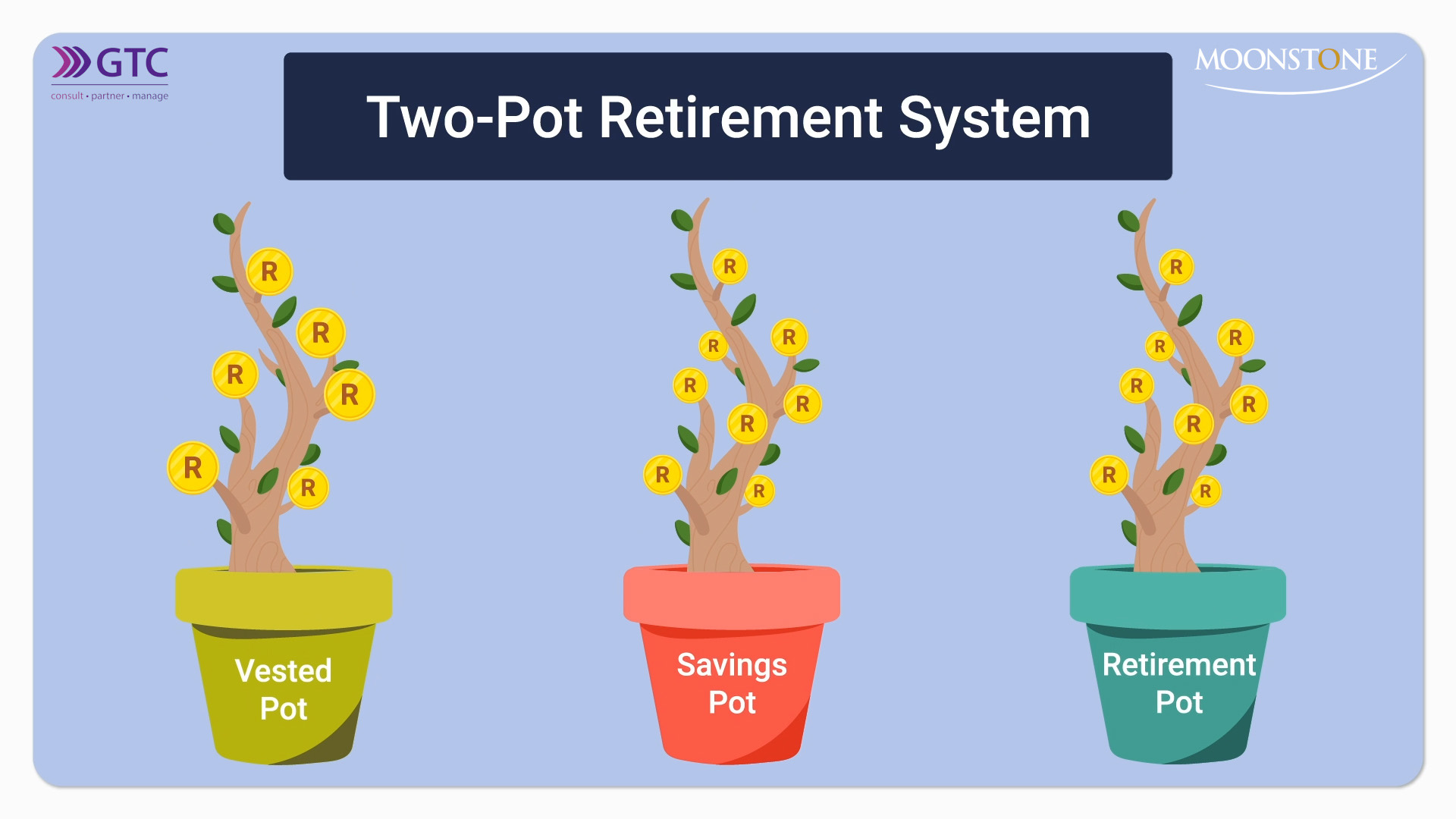

Public Compliance Communication 59 has been issued following two rounds of public consultation.

It is accompanied by three brochures that unpack different aspects of the two-pot system in more detail.

The draft Taxation Laws Amendment Bill addresses a critical anomaly in trust anti-avoidance legislation. By narrowing the transfer pricing exemption, the Bill ensures that only the correct portion of cross-border trust loans escapes double taxation.

The house, which belonged to the broker’s brother, was set alight after the sheriff served an eviction letter on the occupant.

High Court hands down a decision on the interpretation of the tracing provision in section 37C of the Pension Funds Act.

The non-compliance was discovered during inspections by the Prudential Authority in 2020 and 2022.

If a person’s year of assessment is less than 12 months, the allowable retirement contribution deduction will be applied pro rata.

FST upholds the JSE’s decision to fine Tongaat Hulett’s former CFO R6m and bar him from holding office as a director of a listed company for 10 years.

The Companies Amendment Act provides for more disclosure by companies, and the Companies Second Amendment Act extends the time bars to applications for director delinquency and proceedings to recover loss due to director liability.

The former Old Mutual adviser claimed the complainants were not his clients but his relatives who had agreed to lend him the money.

Moonstone Compliance offers a range of services in respect of FICA and anti-money laundering compliance aimed at accountable institutions.

The Authority also agrees to reconsider its decisions to withdraw the licences of four entities.

The FST finds that the FSP’s attempt to use debarment as a tool to resolve an employment dispute is a misuse of the FAIS Act’s provisions.

It was a ‘material factor’ that the specimen signatures were in hard copy, whereas the disputed signatures were electronic.

Non-compliant accountable institutions are hindering efforts to get South Africa off the grey list, says the Financial Intelligence Centre.

The new Labour Court and Labour Appeal Court rules bring significant procedural changes to streamline processes and tackle case backlogs.