Nethengwe to lead OM Bank as launch draws near

With regulatory approval secured, Old Mutual Bank is set to debut later this year, offering a digital-first banking experience tailored for South Africa’s mass market.

With regulatory approval secured, Old Mutual Bank is set to debut later this year, offering a digital-first banking experience tailored for South Africa’s mass market.

Yakhe Kwinana argues that the findings should be set aside, as they were based on flawed reasoning, lack of evidence, and a predetermined agenda to find her guilty.

The joint trustees have managed to recoup R12.4m, but R1.5bn remains in claims. The efforts to recover funds through settlements, asset recovery, and legal action continue.

The case raises questions about whether LCBOs will expand access to affordable private healthcare or threaten the rollout of NHI.

Victims of the Ant Ranch scheme will receive a share of the R475 000 held in terms of a preservation order. However, the money may not go far in reimbursing their losses.

It says the Competition Commission’s ruling hampers access to affordable private healthcare and contradicts recommendations from the Health Market Inquiry.

Cyber insurance and practical measures can shield a business from devastating data breaches and ransomware attacks.

The Hospital Association of South Africa joins other organisations in challenging the NHI Act in court but keeps the door open for dialogue with the government.

Stable growth and fiscal discipline could see South Africa’s credit rating rise two notches in the next three years.

As scammers exploit Banxso investors with fake fund recovery schemes, Banxso and law firm Mostert & Bosman point fingers at each other over data breaches and accountability.

If you’re in the agricultural sector and deal in high-value goods, you may be subject to FICA. Moonstone Compliance’s free webinar will unpack what compliance entails.

While bullish sentiment towards equities cools, local assets remain a top pick for 2025, with gold and bonds gaining favour, BofA survey finds.

Standard Bank’s compliance failures include the untimely submission of suspicious activity reports and neglecting system alerts.

Old Mutual Wealth’s Izak Odendaal believes the only two risks that should concern investors are the US economy going into a recession and the Fed hiking interest rates.

The government, business, and labour are working together at Nedlac to address employers’ non-compliance with payments to retirement funds.

The High Court confirms the Prudential Authority’s right to challenge Tribunal decisions while affirming the limits of retrospective penalties.

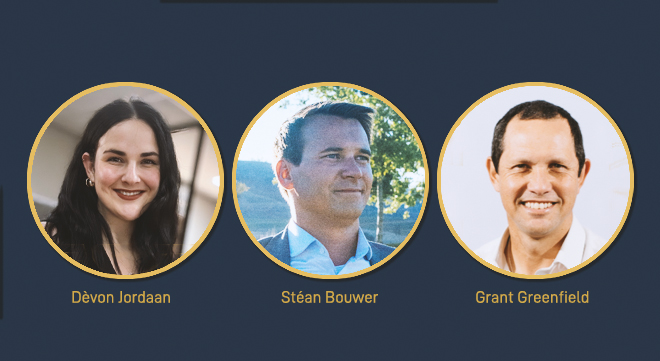

Dèvon Jordaan, Stéan Bouwer and Grant Greenfield, top achievers at Moonstone Business School of Excellence, share their stories on the power of preparation and perseverance.