Santam set to launch Lloyd’s syndicate this year

The anticipated gross written premium for 2026 is between R6.9bn and R9.2bn.

The anticipated gross written premium for 2026 is between R6.9bn and R9.2bn.

A new partnership between the FSCA and IFC signals a clear intent by regulators to align corporate disclosure rules with global sustainability standards.

As a result of the accident, the plaintiff is a paraplegic and will require extensive ongoing medical treatment.

South Africans can now travel visa-free to 103 destinations as the country’s passport climbs five spots to 48th on the Henley Passport Index.

The first Mortality and Morbidity Impact Assessment Framework guides insurers through a structured approach to evaluate long-term climate-driven health risks.

The consultant bypassed the bank’s two-factor authentication and fingerprint checks to manipulate digital records and drain a client’s savings.

The public are also warned that an entity called Mashram United Funeral Undertakers’ Compliance Organisation might be selling unlicensed insurance policies.

The General Laws (Family Matters) Amendment Bill will empower the courts to order fair asset transfers in marriages out of community of property without accrual.

As individual tax filing season officially opens today, SARS warns taxpayers to stay vigilant against a surge in sophisticated scams.

The annual benefit escalations for policies that fall under the Demarcation Regulations.

After the High Court remitted the matter, a new Tribunal panel deemed the challenge ‘frivolous and vexatious’.

Determination says a ‘reasonable broker’ would supplement a bulk email with an email or phone call to ensure the client is aware of new conditions.

Transport Minister Barbara Creecy dissolved the RAF’s board to tackle governance issues, but its impact on victims remains uncertain.

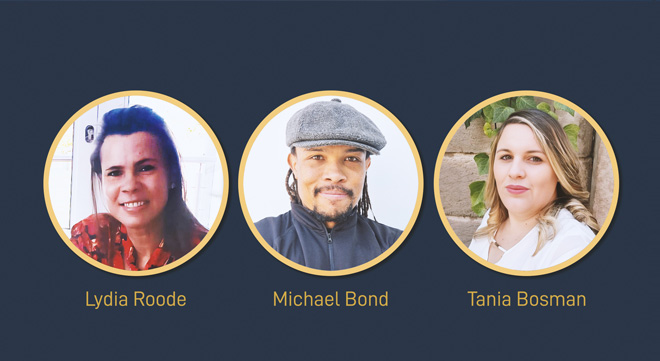

How MBSE graduates like Lydia Roode and Michael Bond leveraged the Higher Certificate in Short-term Insurance to excel in real-world scenarios.

The Tribunal agrees with the FSCA that the entity’s key individual did not ‘come clean’ about her past misconduct.

The final Notice removes confusing references to section 14(8), but calls for a wholesale carve-out of retail-to-retail transfers were turned down.

As rental demand surges, advisers can help clients navigate the insurance complexities of furnished, semi-furnished, and short-term lets.