There’s the good news, the not-so-good news – and then the bad news

That’s one way to frame the Association for Savings and Investment South Africa’s 2025 Industry Transformation Report, released this week. The report tracks progress since the amended Financial Sector Code (FSC) came into effect in 2017, drawing on data from members employing 80 000 people, representing 98% of life offices’ assets under management (AUM), and 83% of asset managers’ AUM.

The good news: life offices and asset managers now report a meaningfully transformed ownership profile.

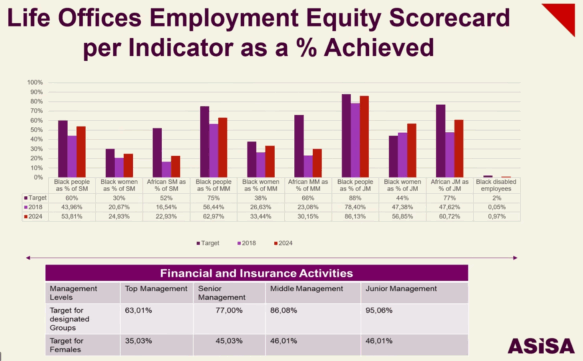

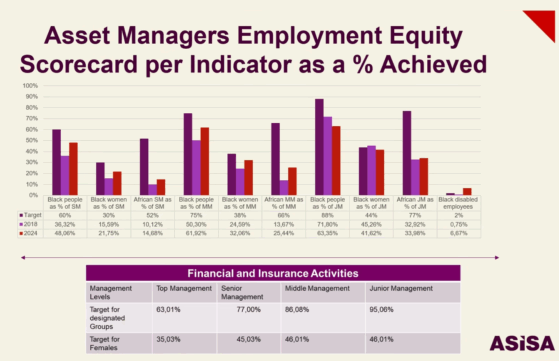

The not-so-good news: although employment equity indicators have improved since 2018, many targets remain unmet and transformation at management levels lags.

The bad news: the FSC targets used in the report do not align with the stricter requirements set by the Department of Employment and Labour (DoEL) earlier this year. This may lead to penalties and restricted participation in an already fragile economy.

Under section 15A of the amended Employment Equity Act (EEA), effective 1 January 2025, the Minister of Employment and Labour can set numerical targets for defined economic sectors. On 15 April, Minister Nomakhosazana Meth published Government Notices 6124 and 6125, setting five-year equity targets across 18 sectors.

The final sector targets are set for men and women from “designated groups” generally and are not broken down further per population group.

“Designated groups” are defined in the Act as black people (Africans, coloureds, and Indians), women, and people with disabilities who are South African citizens by birth, descent, or certain conditions of naturalisation.

Targets apply to top, senior, professionally qualified, and skilled technical levels, with compliance mandatory for employers with 50 or more staff.

Read: Employment equity targets drop key safeguards from Solidarity deal

The good news

The report shows solid progress across most elements of the FSC scorecard, with ownership transformation leading the way, according to ASISA chief executive Kaizer Moyane (pictured). Black South Africans owned 30% of life offices and 39% of asset managers at the end of 2024. Black unencumbered shareholding in life offices more than doubled from 14%, while asset manager ownership rose from 22%.

Moyane noted that voting rights and economic interest for black South Africans also exceeded targets. In life offices, voting rights rose to 46% and economic interest to 36%; in asset managers, voting rights reached 49% and economic interest 43%, all above the 25% threshold.

The not-so-good news

Progress on management control and employment equity remains uneven. Although executive-level black representation has improved, targets under the FSC have not been met. The report cautioned: “Because the number of executives is small, any changes in board and executive directors’ representation significantly affect the percentages, leading to volatility in the reported outcomes.”

In life offices, black board representation fell since 2023, below 2018 levels. Executive management saw gains, with black executives rising from 29% in 2018 to 47% in 2024, against a 60% target, and black women from 8% to nearly 25%, approaching a 30% target, said Lister Saungweme, ASISA’s senior policy adviser for transformation.

In asset management, black board representation exceeded the 50% target since 2020, reaching 55% in 2024. Black executive directors accounted for 46% of boards, and black executive managers 50%, both below targets. Black women in executive roles rose from 15% to 22%, short of the 30% goal.

Employment equity also remains uneven. Life offices improved across all levels, with only black individuals and black women in junior management meeting targets. Asset managers advanced at senior and middle levels but declined at junior levels.

The report said: “It remains concerning that none of the targets have been met, except for those set for black individuals with a disability.” Overall, “in all respects, there has been an increase in percentages since 2018”.

The bad news

Despite steady improvements, stricter DoEL targets now widen the gap, exposing the sector to regulatory and reputational risk.

Saungweme said: “If one is to zoom into just a snippet of the employment equity targets that have been set at sectorial level versus the financial sector targets that we are still working towards, one can see that at senior management, the target for black people in the code is 60% but then the Department of Labour has put the target at 77%. We’re still not there in terms of achieving the FSC targets, and yet the Department of Labour has already increased the senior management targets to 77%.”

Middle management faces a similar gap: FSC 75%, DoEL 86%. Junior management targets were raised to 95%, above the FSC’s 88%.

Asset managers face the same challenge, she said: “So with two different pieces of legislation setting targets, automatically the one that has got the higher set of targets becomes the benchmark.”

Target mismatch

Moyane indicated that there were no immediate plans to align the FSC targets with the DoEL’s. He noted the FSC recognises sector-specific nuances, while the DoEL aggregates targets across financial services, potentially overlooking skills shortages.

“Where we think a target is maybe 60%, they [the DoEL] are saying it’s 77% because they have aggregated everyone… which is quite problematic for us,” he said.

ASISA has submitted data to the DoEL highlighting differences between life offices and asset managers, but Moyane said it has yet to be given “due consideration”.

He argued for using real skills data to set realistic targets: “If we are going to use data from the SETAs, we can see what the pool of skills looks like, and out of that, we should be able to see the gaps between where we are and the target, and so you can set realistic targets that way.”

On government-business gaps, he cited misalignment between departments.

“The DTIC [which oversees the FSC] … understands the nuances of the sector… In comes the Department of Employment and Labour, with its own set of targets… I don’t think there has been any alignment… and that may very well account for why we see this mismatch,” he said.

FSC and COFI: multiple layers make compliance hard to ignore

The draft regulations sparked debate over whether targets amounted to quotas. Critics argued they could be unconstitutional. The DoEL rejected this, maintaining targets are flexible, allowing employers to set annual plans towards five-year goals.

Saungweme said the FSC is currently “quasi voluntary”. “But obviously, it’s become a trading or a social licence for one to trade in the country… So theoretically, it’s voluntary, but then the market dynamics make it almost a must.”

She adds that the Conduct of Financial Institutions Bill will add another layer of complexity.

“Because when the regulations are passed and the regulators are going to be regulating in terms of the movements or the levels of transformation. So that is going to make it more mandatory if, as it were, because it’s not only going to be about producing a BEE certificate for procurement for the next player, but then you will be regulated in terms of your trajectory or your transformation strategy. So yes, there are multiple angles in which government and regulators are processing the transformation agenda.”

Anderson Insurance Underwriters (AIU) employed 98 individuals, the majority of whom were Black South Africans – 2009 to 2016. When Constantia Insurance suffered financial failure, the Financial Sector Conduct Authority (FSCA) did not step in to facilitate the transfer of policies to a new carrier. Instead, Constantia shifted the blame onto AIU, despite the fact that Constantia had long been under FSCA monitoring for failing to meet financial requirements—well before AIU’s involvement. As a direct result of FSCA’s reluctance to intervene appropriately, 98 employees lost their jobs.