Are South African financial advisers undercharging for the value they deliver? The average ongoing advice fee hovers around 0.5% of assets, but international comparisons suggest there is room for local advisers to increase their fees, says Mark Polson, the chief executive of The Lang Cat, a UK-based financial services-focused consultancy.

The Lang Cat compiled the recently released Adviser Barometer for Allan Gray. The report was based on answers to a survey conducted towards the end of 2024. All advisers contracted with the Allan Gray Investment Platform were invited to participate.

Read: ‘Little appetite’ for shift from asset-based charges and commission

During a webinar this week, Polson and Daniel van Andel, the head of platform and adviser proposition at Allan Gray, discussed aspects of the Barometer’s findings.

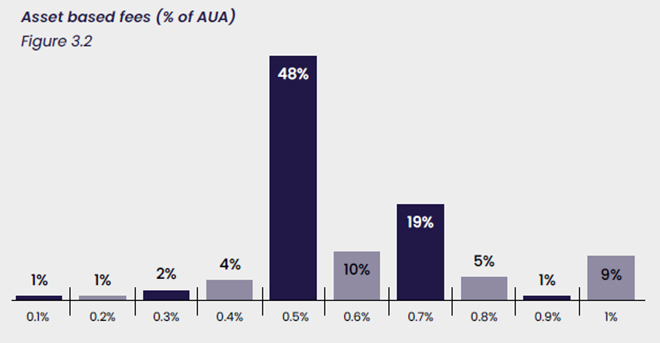

According to the Barometer, nearly half of the surveyed advisers charge an ongoing fee of 0.5% on assets under management (AUM), with about 20% charging 0.75%, and a smaller portion charging 1% or more.

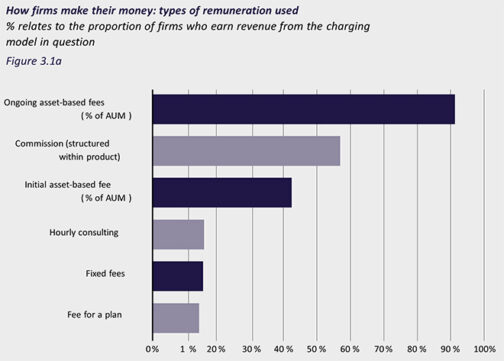

About 90% of advisers’ revenue comes from AUM-based ongoing fees, indicating a heavy reliance on this model.

In addition to ongoing fees, some advisers charge alternative fees, although these are less prevalent. For example, hourly consultation fees have a midpoint of about R1 500 per hour, while upfront fees for financial plans can range up to R50 000 to R60 000 for more complex cases. However, only about 10% of advisers incorporate these alternative fee structures into their pricing models.

Van Andel said the survey’s findings are consistent with data from the Allan Gray platform, which suggests that many advice businesses break even at the 0.5% fee level, covering operational costs but leaving limited room for profit.

Polson said internationally there is a correlation between remuneration based on commission from an investment product and an average fee of 0.5%, whereas the further a sector moves from that model, the more likely fees will approximate 1%.

When a financial sector moves towards a more transparent, “unbundled” regulatory environment, costs go up, and charges also increase “for those who are closest to the client”, he said.

Compared with the UK, South African advice fees are notably lower. In the UK, the weighted average ongoing fee for financial advice is about 0.78% of AUM.

The UK market also exhibits greater diversity in fee structures. Although AUM-based ongoing fees remain a significant component, about 40% to 45% of UK firms incorporate a mix of fee models, such as minimum fees or tiered charging structures. The Barometer referred to a “two-thirds, one-third” structure, where two-thirds of revenue comes from ongoing AUM-based fees and one-third from initial or alternative fees. This approach helps firms to avoid over-dependence on market-linked income and provides greater business resilience, providing a more balanced approach to income generation.

A key difference between the two markets lies in their evolution. The UK’s fee landscape shifted following the Retail Distribution Review, which banned commission-based earnings and encouraged transparent, fee-based models. This regulatory change prompted UK advisers to increase their fees over time.

By the standards of some other notable markets, Polson said South African advisers who are charging around 0.5% “are delivering exceptional value” for their services, and “there is room to move up”.

He acknowledged that many advisers’ response is that their clients will not accept higher fees. However, Polson said clients do not want to lose what they really value from a financial adviser: emotional support, coaching, and “all the stuff” that goes with financial planning.

“So, nobody likes paying more, but the fear of loss of that service is much greater, and so well-handled exercises to increase fees can actually work absolutely fine.”

Polson acknowledged that it takes “quite a lot of bravery” to increase fees, and not every client will accept them, but he believes it can be done.

“I’ve been involved in those exercises, and I’ve seen what’s happened, and I can see them work,” he said.

The discussion also touched on the issue of discounting. Advice firms in the UK may advertise a certain ongoing fee rate, but the actual average or “blended” fee charged across their client base is often lower – sometimes under 0.5%. This reduction is not only due to tiered pricing for larger portfolios but also because some clients negotiate lower fees or push back against the standard rate. Rather than risk losing these clients, advisers may agree to discount their fees.

Polson said discounting is a common but often underreported practice in the industry. It can have a significant impact on the overall revenue and sustainability of an advice business, so advisers should be mindful of how much discounting they allow and ensure their pricing strategy remains viable in the long term.

Another lesson is the importance of focusing on the lifetime value of clients. Building relationships with clients who may have modest portfolios today but could grow significantly over time is a sound long-term strategy. This perspective encourages advisers to look beyond immediate profitability and invest in nurturing client relationships.