South African investors now have the opportunity to tap into private-market investments historically reserved for institutional players.

Regulatory changes in the United States and Europe allow wealth managers to incorporate private-market exposures into individual investors’ portfolios. Consequently, global allocations to private markets, once the domain of large institutions, are projected to rise from near zero to between 5% and 20% by 2030.

Liam Davis, the lead chief investment officer for wealth solutions at BlackRock, said: “Private markets have long been fundamental to institutional portfolios globally. Evolving regulatory frameworks now make it possible to extend these benefits to retail investors.”

Cogence has leveraged this environment to expand access to global private-market opportunities for South African investors through a local solution enabled by its strategic association with BlackRock, one of the world’s largest asset managers.

The launch introduces the Cogence Diversified Markets and Cogence Global Diversified Markets portfolios, which blend public and private market investments while offering some liquidity options.

Jonel Matthee-Ferreira (pictured), the chief executive and CIO of Cogence, said: “Private markets are reshaping how modern portfolios are constructed. South African investors can now pair the liquidity of public markets with the growth potential of private markets and in doing so, unlock global reach and deeper diversification for long-term resilience.”

Why private markets now

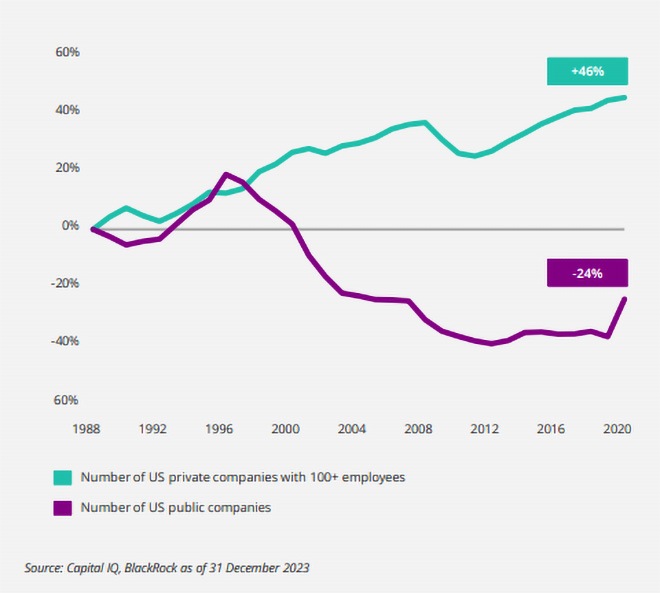

For decades, public stock markets have been the primary vehicle for individual investors to grow wealth, providing liquidity, transparency, and broad access. However, the stock market is shrinking: fewer public companies are listed on major exchanges, and investors have access to a smaller portion of the global economy. This structural limitation has prompted growing interest in private markets, one of the fastest-growing segments of global capital markets.

Cogence explains that private markets – which include private equity, private credit, infrastructure, and real estate – offer access to assets that are not traded on public stock exchanges. Gaining exposure to these markets gives investors a broader universe of companies and assets unavailable through traditional public-market avenues, unlocking potential opportunities for diversification and long-term growth. Historically, these asset classes were largely reserved for high-net-worth and institutional clients because of high minimums, illiquidity, and long lock-in periods.

With the Cogence Diversified Markets and Cogence Global Diversified Markets portfolios, Cogence has leveraged its association with BlackRock to provide retail investors with seamless access to private markets via the Discovery local endowment.

Private-market strategies have evolved into an essential component of portfolio construction. According to Matthee-Ferreira, private markets provide exposure to structural global trends that are reshaping economies, including artificial intelligence, energy transition, demographic shifts, and digital infrastructure. She added that market volatility and political risks underscore the need for active management and diversified portfolios.

“Markets have confirmed again that the world is going for a period of profound change… diversification has changed… you need new ways of diversifying,” she said.

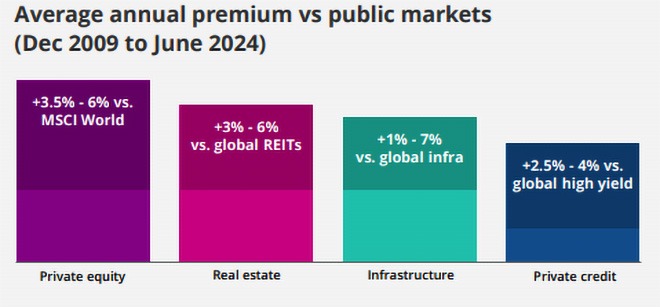

The inherent illiquidity of private markets – once a barrier – can also be an advantage, providing a liquidity premium, or higher returns to compensate for restricted access.

Over the past decades, private markets have outperformed their public-market counterparts, delivering higher returns across asset classes: private equity has historically exceeded broad market equity indices by 3% to 6%, private infrastructure by 1% to 7% relative to listed equivalents, and private real estate has outperformed REITs.

Davis explained that although private markets carry volatility similar to equities or sub-investment-grade credit, their low correlation with public markets allows investors to maintain comparable overall portfolio risk while capturing alpha upside.

Private-market strategies also allow investors to participate in sectors that require significant upfront capital, such as infrastructure, data centres, and AI-driven businesses, which may not be feasible for public-market investors.

By integrating these assets into a portfolio alongside listed investments, retail investors can diversify across asset types, geographies, and global growth themes, while still accessing liquidity within a two-year window for emergencies or life events.

How Cogence opens the door

The Cogence portfolios invest in private and public markets across all asset classes, with the private-market allocation currently making up about 15% of the portfolio. This level was chosen to balance long-term return potential with liquidity constraints and regulatory requirements.

Access is provided via the Discovery local endowment, which acts as a legal and tax-compliant wrapper. Minimum investments are aligned with Discovery’s standard endowment minimums, which are significantly lower than traditional private-market minimums that historically required large, long-term commitments.

Advisers can confirm the current rand minimum applicable to each investor.

The portfolios are designed to offer practical liquidity options: investors can make regular contributions, access scheduled quarterly redemption windows, and benefit from a liquidity buffer held in more liquid assets. Although this is not a vehicle for daily trading, it allows withdrawals in the event of life needs or other emergencies, with the best outcomes expected when investors remain invested for five years or longer.

Matthee-Ferreira explained that these portfolios leverage new structures adopted internationally, particularly in the UK, that allow private-market allocations to retain a two-year liquidity constraint, significantly shorter than the traditional five-to-seven-year lock-in period for private-market funds.

How Cogence and BlackRock work together

The solution brings together three components:

- Cogence (portfolio design and advice): determines the strategic allocation to private markets within diversified, goal-driven portfolios.

- BlackRock (private markets engine): sources and manages a globally diversified range of private-market investments, providing institutional-grade exposure.

- Discovery endowment (wrapper): facilitates contributions and withdrawals while providing a legal and tax-compliant structure.

Davis noted that the objective is not to take excessive risk, but to optimize portfolio efficiency by adding private-market allocations that behave differently from public equities and bonds, delivering potential upside without increasing overall portfolio risk.

Strategic benefits for investors

According to Cogence, private markets provide diversification and exposure to global growth drivers that complement public equities and bonds. The inclusion of private equity, infrastructure, and real assets enables retail investors to participate in sectors that were historically off-limits, potentially enhancing returns while smoothing portfolio volatility.

Private markets also allow for alternative income streams, including annuity-style payments from certain investments, which help manage cash flow risks compared with traditional lump-sum payouts.

Matthee-Ferreira noted that for South African investors, this combination of public- and private-market exposure represents a transformative moment: “You can now pair liquidity with the growth potential of private markets, unlocking global reach and deeper diversification for long-term resilience.”

Disclaimer: The information in this article does not constitute investment or financial planning advice.