How the HCSTI shapes confident, career-ready brokers

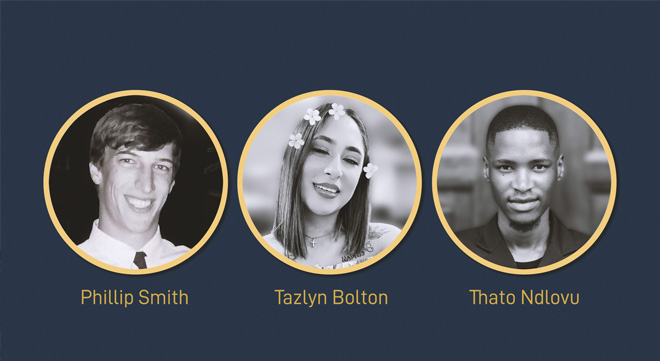

MBSE top achievers share how the HCSTI turns ambition and experience into long-term growth in short-term insurance.

MBSE top achievers share how the HCSTI turns ambition and experience into long-term growth in short-term insurance.

Discovery Insure warns that inactive or faulty tracking devices may leave motorists without hijacking or theft protection.

This edition of Cover to Cover explains medical scheme dependant rules, required documentation, and how advisers can help clients keep their families covered.

Disciplined underwriting, improved claims experience, and robust investment income helped non-life insurers to navigate structural headwinds.

KPMG’s survey shows broad improvement across major life insurers, driven by moderate premium growth, stronger investment returns, and efficiency gains.

Results from operations rose 16% to R4.94bn in the six months to June, boosted by a 71% surge in Old Mutual Insure’s contribution.

For the six months to June, Santam reports net income growth of 19%, with a underwriting margin of 11.3% – well above its target range.

Santam’s Thabiso Rulashe on how insurers are adapting to stay resilient – and profitable – in an era of rising risks.

From early-warning systems in liability cover to behaviour-based motor premiums, local insurers are adapting AI tools to South Africa’s unique risks.

Policies subject to underwriting had the highest payout rates in 2024, reflecting lower fraud and non-disclosure and the value of comprehensive risk assessment.

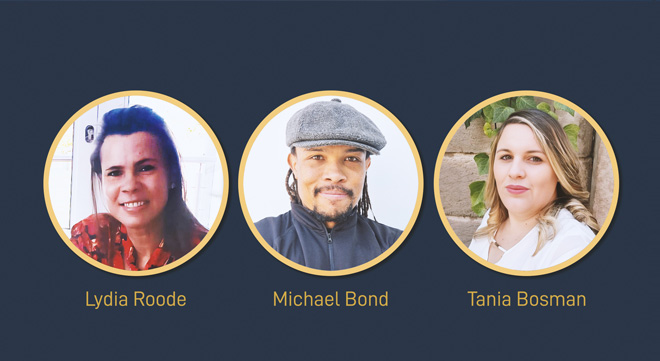

How MBSE graduates like Lydia Roode and Michael Bond leveraged the Higher Certificate in Short-term Insurance to excel in real-world scenarios.

Changes such as joint ventures, investing in infrastructure, and switching to higher-value crops can introduce risks that may not be covered.

Luvuyo Burial and Consulting did not pay the claims in full even after the Ombud’s Office intervened.

The beneficiaries waited months to be paid their funeral policy benefits, but they received only partial pay-outs despite undertakings to the contrary.

Exceptional underwriting in Old Mutual Insure and a 37% jump in Investments drive overall strength, but Corporate’s life insurance sales slumped 42%.

The policyholder inflated her earnings and failed to disclose a simultaneous application with another insurer, materially affecting the risk assessment.

Nearly all business units report strong growth in new business volumes.