R9.2m RAF claim crashes over tailgating and lack of proof

A High Court ruling shows that failing to keep a safe following distance – and failing to back up your story with solid evidence – can cost you your case as well as your claim.

The government finally cuts payers of personal income tax some slack – and increases the medical scheme tax credits.

A High Court ruling shows that failing to keep a safe following distance – and failing to back up your story with solid evidence – can cost you your case as well as your claim.

Pierre Erasmus said the sanctions were disproportionate, and his dealings with clients were friendships, not formal business relationships.

Discovery Bank reported its first profitable half, while Discovery Insure’s operating profit jumped by 229%, helped by lower claims and favourable weather.

Eastern Cape court rules section 25 claims need credible proof of electricity causing damage.

It is also open to discussions on letting members transfer all their vested savings into their retirement and savings components.

The misalignment between the FSC benchmarks and stricter government employment equity targets is set to increase the transformation pressure on life offices and asset managers.

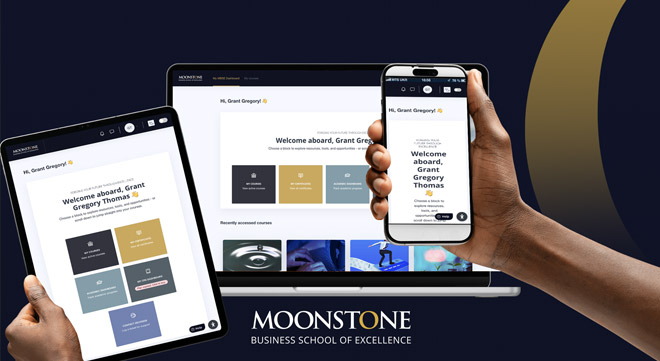

Students can now access MBSE’s courses and materials with a single click from desktop or mobile, enjoying seamless, on-the-go learning without opening a browser.

The first edition of our new series unpacks the types of medical plan, who they suit, and why the cheapest option isn’t always the smartest choice.

The funeral provider has faced repeated determinations this year after failing to settle valid claims.

The code sets out how dismissals must meet substantive and procedural fairness requirements.

The Authority signs an agreement with SABRIC and the Southern African Fraud Prevention Service to enable a faster system-wide response to scams.

Results from operations rose 16% to R4.94bn in the six months to June, boosted by a 71% surge in Old Mutual Insure’s contribution.

The FSCA also cautions against dealing with Hlalani Rocken Nkuna, who markets trading signals but is not authorised.

Industry stakeholders say poorly consulted proposals risk undermining investment, savings, and innovation.

Proposed amendments could undermine the tax-efficient compounding that makes a collective investment scheme an attractive investment vehicle.

The curator will assess Sizwe Hosmed’s finances and recommend whether it should merge, be liquidated, or continue.

The client initially swore to non-consent, but in a second affidavit he said drugs clouded his memory, insisting he was present when the policies were initiated.