As we approach the end of February, phrases such as “tax year-end” and “financial year-end” become part of everyday conversation. This period is crucial for South Africans because it marks the deadline for ensuring all contributions, deductions, and tax-related decisions are finalised before the new tax year begins. These actions ultimately shape the tax return you will file in July when the South African Revenue Service officially opens tax season.

As a financial planner, I am often asked the same questions at this time of year:

- How can I reduce my tax?

- Which strategies can I still use before the end of February?

- What opportunities does SARS give us through legislation?

There are two strategies that consistently help individuals to reduce their tax burden while building long-term wealth.

- Investing in a retirement annuity

If you don’t belong to a company fund where you can make additional contributions, a retirement annuity (RA) remains one of the most effective tools for reducing taxable income before the tax year-end.

By investing in an RA, you can reduce your taxable income for the year. SARS allows you to deduct up to 27.5% of your taxable income or remuneration, capped at R350 000 a year, whichever is lower.

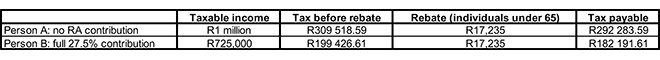

For example, a person earning R1 million who contributes the full 27.5% (R275 000) reduces their taxable income to R725 000.

- Tax saving: R110 092

- Effective tax rate drops from 29.2% to 25.1%

Person B not only reduces their tax immediately but also invests significantly towards their retirement.

Some of the other key benefits of an RA are:

- Tax-free investment growth: No tax on interest, dividends, or capital gains inside the RA, allowing your money to compound faster.

- Beneficiary nominations: You can nominate beneficiaries so the funds do not automatically form part of your estate (although the allocation is still subject to section 37C of the Pension Funds Act), which can reduce certain estate costs.

- Creditor protection: RAs are generally protected from creditors, offering an additional layer of financial security for professionals and business owners.

- Portable across employers: Your RA is independent of your job – you can continue contributing even if your employment changes.

- Flexible contributions: You can increase, decrease, or pause the contributions based on your financial situation. Many investors don’t realise they can also make ad-hoc lump-sum contributions – it doesn’t need to be a fixed monthly debit order.

- Structured for long-term discipline: Funds cannot be accessed before the age of 55 (except in specific circumstances), helping investors stay committed to long-term retirement goals.

- Long-term growth through a TFSA

A tax-free savings account (TFSA) offers unmatched long-term benefits: all interest, dividends, and capital growth are completely tax-free.

There is an annual contribution limit of R36 000, with a lifetime limit of R500 000.

Unused TFSA allowances cannot be carried forward. If you don’t invest before the end of February, you lose the opportunity for that year permanently, and it takes you longer to reach the lifetime limit.

TFSAs are ideal for long-term wealth because of their tax efficiency and flexibility, making them perfect for investors who want accessible, penalty-free savings with compounding growth over time.

Why you should act early, not in late February

Many people only realise the need to contribute to an RA or TFSA late in January or even deep into February. Although this is understandable, it often creates unnecessary pressure on both financial planners and investment institutions. Providers face a surge of last-minute instructions, and in some cases, processing times are delayed because of high volumes. This can result in contributions reflecting after 1 March, meaning they fall into the next tax year, and investors lose out on the deduction or TFSA allowance they intended to use.

For this reason, it’s crucial to engage with your financial planner sooner rather than later to ensure the strategy, paperwork, and contributions are finalised well before the deadline. You also benefit from compound interest for longer on the higher amount.

Using an RA and TFSA thoughtfully allows you to:

- Reduce your taxable income;

- Increase your potential tax refund;

- Grow long-term, tax-efficient wealth; and

- Strengthen your retirement and financial security.

With the right planning, SARS effectively helps you save. Use this window to your advantage. If you’re unsure how much contribution room you still have or how to structure these strategies for maximum benefit, speak to a qualified financial planner. Small decisions today often create the biggest rewards tomorrow.

Zander Loots (CFP®) is a financial adviser at Alexforbes.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is of a general nature and does not purport to be financial planning or tax planning advice that is appropriate for every individual’s needs and circumstances.